Tomorrow could be a key breakout day for the EUR/USD. The market will be fixated on Jackson Hole speeches especially one by Mario Draghi. As we noted earlier today, “Mr. Draghi, on the other hand, must dampen any expectations of an immediate taper despite the fact that conditions in the Eurozone have improved materially and ultra – accommodative policy is no longer necessary. The ECB is keenly aware of a market overshoot vis a vis exchange rates and does not want to see EUR/USD trade above the 1.2000 level into Q4 of this year for fear of making exports from the region uncompetitive.

Thus, Mr. Draghi’s task is in some ways more difficult and unless he unequivocally states that no taper is coming for the foreseeable future, the EUR/USD could shrug off any knee jerk selloffs. “

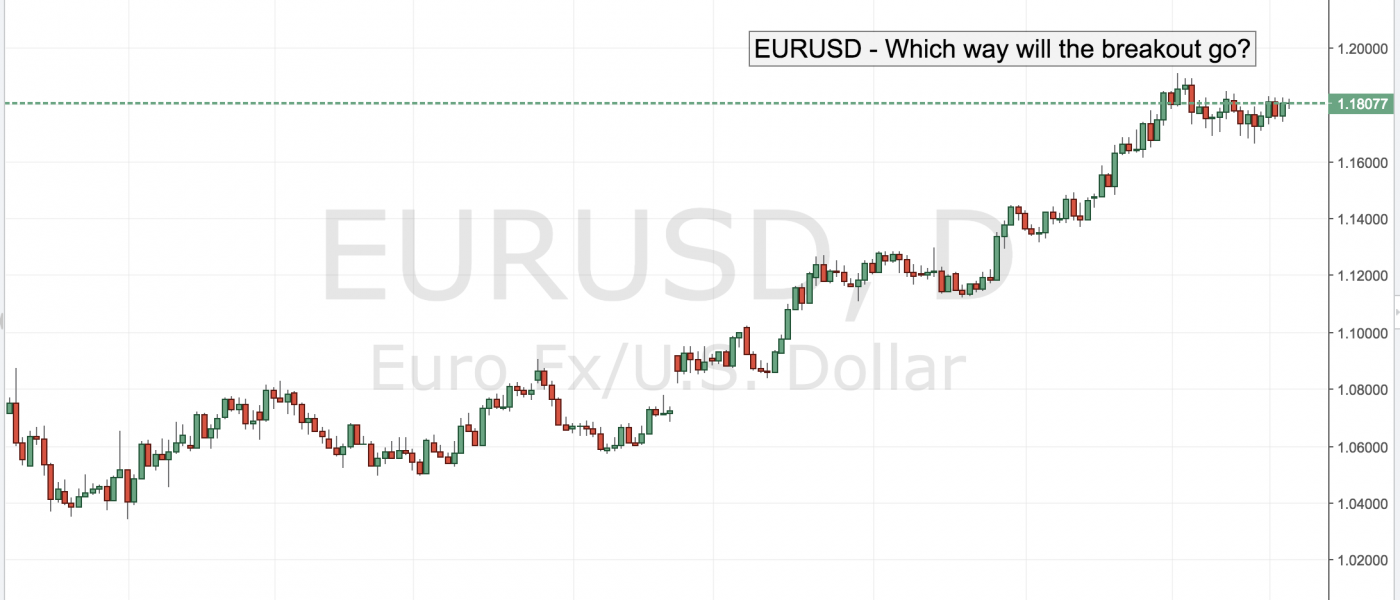

The EUR/USD has hovered on both sides of the 1.1800 figure for the better part of two weeks and if it makes a break tomorrow the direction could be long lasting with the pair setting the tone for the next few weeks.

Leave A Comment