Video length: 00:08:50

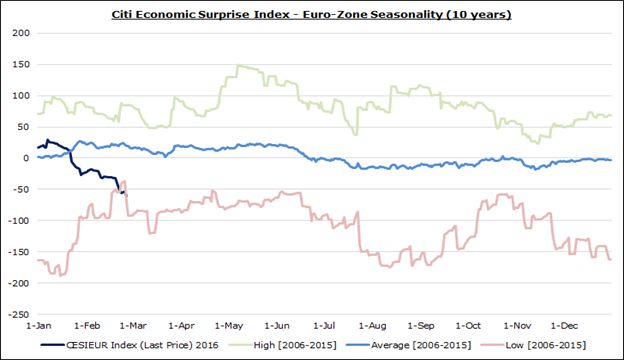

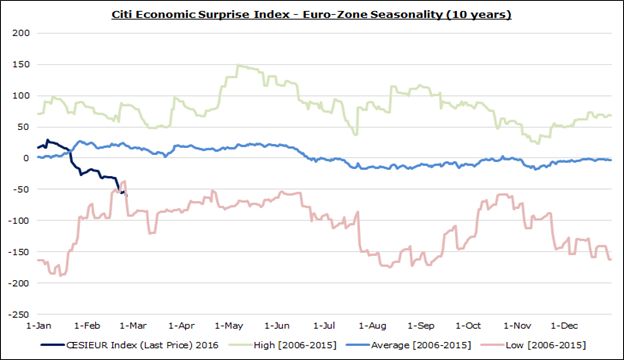

The thematic tug-of-war in the Euro’s underlying fundamentals continues to play out, although the scales have tipped in favor of the bears in recent days. The ongoing slide in Euro-Zone economic data relative to expectations (chart 1 below) has weighed on the EUR-crosses on advance to the March 10 ECB meeting, and the lack of a material rebound in energy prices has compounded the deteriorating inflation outlook.

Chart 1: Euro-Zone Citi Economic Surprise Index – 10 year Seasonality

The indication of price pressures receding into deflation territory merely.confirms what we’ve known for several weeks now: markets are fully committed to the belief thtat the ECB will cut its deposit rate by 10-bps at its next meeting. Yet this all seems far too familiar – there is a sense of déjà vu coursing its way through the markets. Investor behavior and price developments hint at a replay of late-November/early-December 2015 for EUR/USD especially.

Leave A Comment