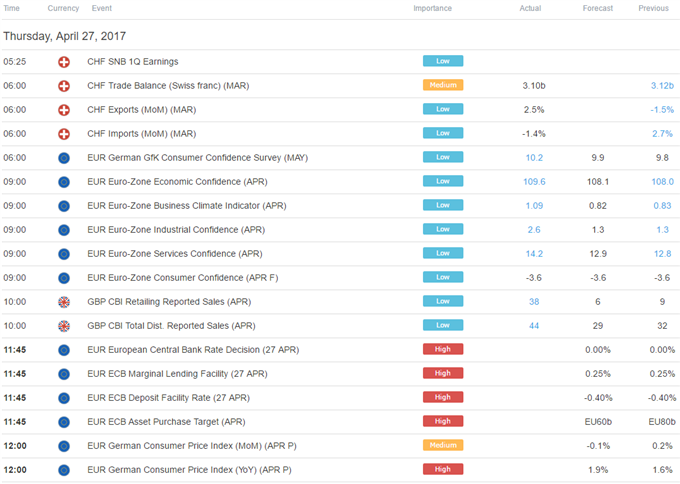

A monetary policy announcement from the European Central Bank headlines the economic calendar. Changes aside from the implementing the previously announced intent to reduce the size of monthly asset purchases – down to €60 billion from €80 billion previously – are not expected.

When that change was unveiled some months ago, it was coupled with an extension of the program. In sum, the adjustment translated into a bit more aggregate stimulus for 2017 than under the previous regime. The markets may still need reassurance lest a “taper tantrum” breaks out however.

With that in mind, ECB President Draghi is likely to strike an unmistakably dovish tone at the press conference following the policy decision. He will probably stress that the central bank intends to maintain a firmly accommodative posture for the foreseeable future, weighing on the Euro.

The British Pound outperformed, rising alongside UK government bonds. This points to increased demand for GBP-denominated paper as the catalyst for the move, but a discrete trigger is not readily apparent. Regional portfolio rebalancing driven by bets on a dovish ECB is one possible explanation.

The Canadian Dollar corrected higher having plunged to a 14-year low in the preceding session. The move followed reports that US President Donald Trump has opted not to seek an exit from NAFTA, a free trade agreement with Canada and Mexico, having previously threatened to do so.

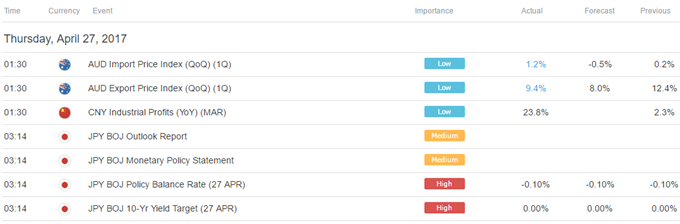

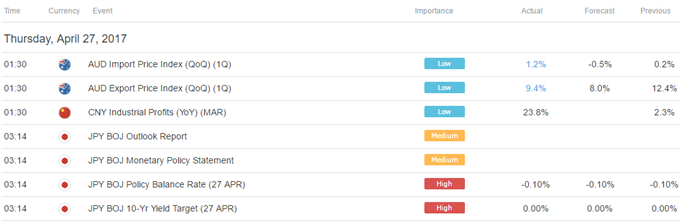

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

Leave A Comment