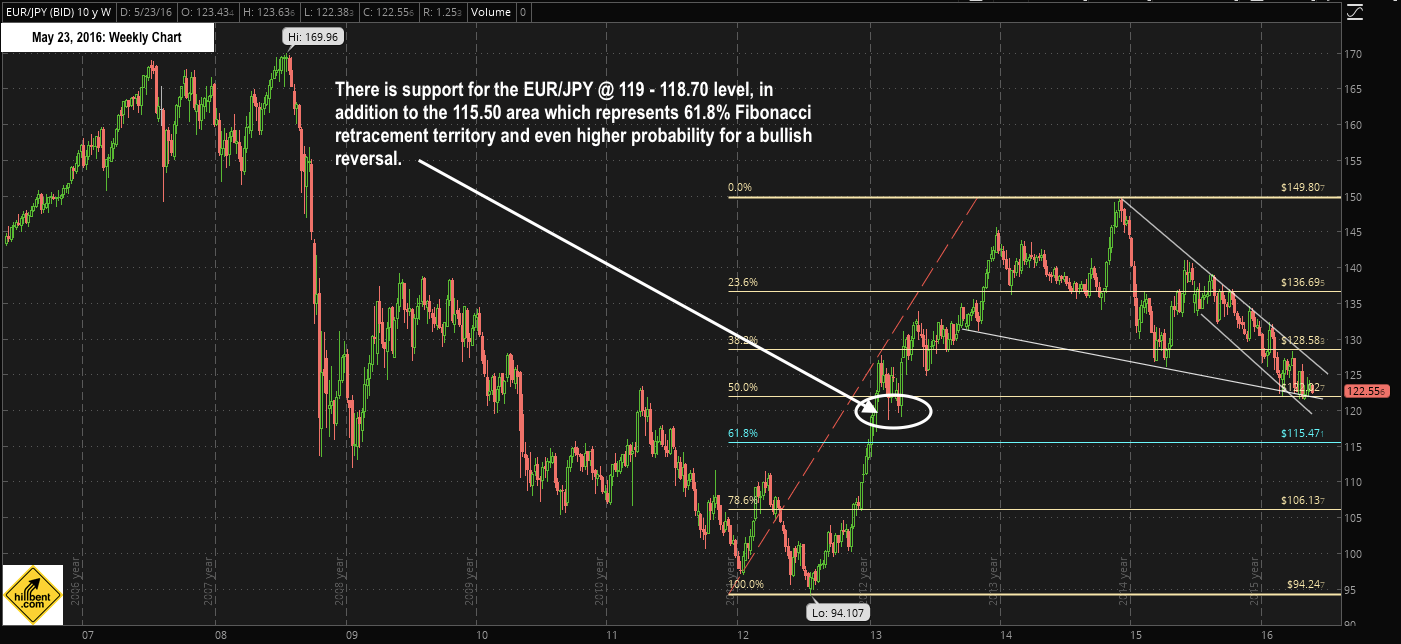

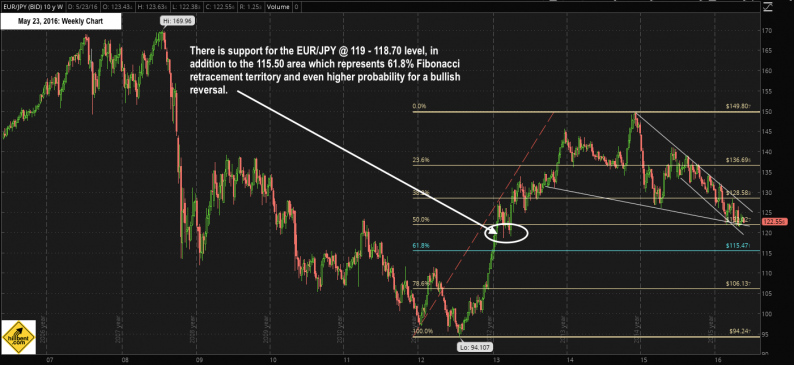

The US Dollar vs Yen (USD/JPY) has garnered most of the attention in the currency markets. However, another forex pair that has intrigued me is the Euro vs Yen (EUR/JPY). The weekly chart I have provided below indicates the trend is clearly bearish, but after having completing a 50% retracement, it is very close to its 2013 support level @ 119 – 118.70. Of course, a full 61.8% retracement to @ 115.50 would not be all that surprising either. (See chart below.)

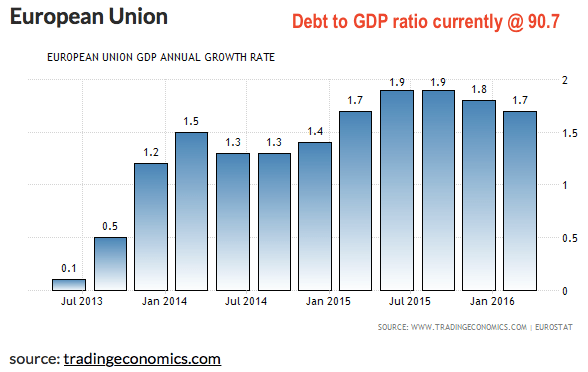

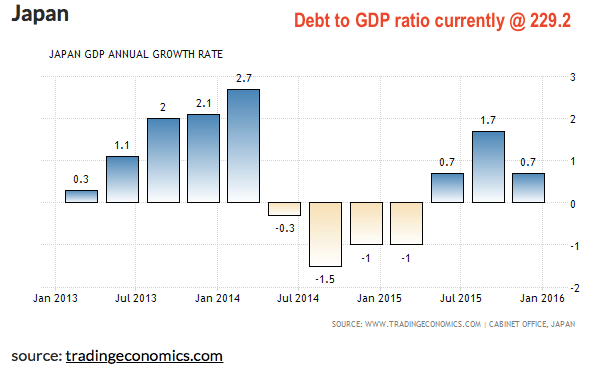

Although the primary purpose of this report is to alert readers to the EUR/JPY’s convergence towards key price support levels, I want to briefly diverge and make some brief economic comparisons. What surprises me most about the relative strength of the Yen vs Euro is the fact that Japan has been unable to stimulate any meaningful growth with its policies. Although both economies are struggling to reach their target inflation rates @ 2% and avoid deflation, Europe is showing some signs of growth as its PMI is @ 51.5 vs Japan’s 47.6, which is contracting. Since pictures sometimes tell stories better words, I have included a charts of Europe and Japan’s respective GDP trends and Debt to GDP ratios.

(Yes, I am fully aware that Japan surprised the market with much higher than expected GDP in its most recent report reflecting quarterly growth @ 0.4% vs. estimates @ 0.2% and previous @ -0.2%. However, Bloomberg’s consensus of economists are projecting +0.9% in 2Q-16, +1.6% in Q3-16, and +1.9% in Q4-16, which I doubt will occur given the strength of its currency and its dependency on exports. Besides, the effects of the April-2016 earthquake have not been factored in and will most certainly impact growth.)

Getting back to the matter at hand and to summarize my analysis, the reward to risk ratio becomes a lot more attractive if the EUR/JPY trades anywhere between the above mentioned support levels. At such prices, I could very well become bullish and foresee the potential for an upside snap back to 125 or even 128 over before year-end. My time frame for such is over the next four to eight months.

Leave A Comment