Previous:

On Tuesday the 31st of October, trading on the euro/dollar pair closed slightly down. The price spent the day trading within a 36-pip range from 1.1625 to 1.1661. Euro bulls tried three times to induce a rebound from 1.1625 levels, but the price was dragged back to the balance line as the dollar was trading up against almost all the majors.

I still can’t understand what sellers were expecting given that the euro/pound cross fell and US bond yields rose. The Chicago PMI and the Conference Board consumer confidence index came out better than expected. This has created favorable conditions for a breakout of 1.1600.

Day’s news (GMT+3):

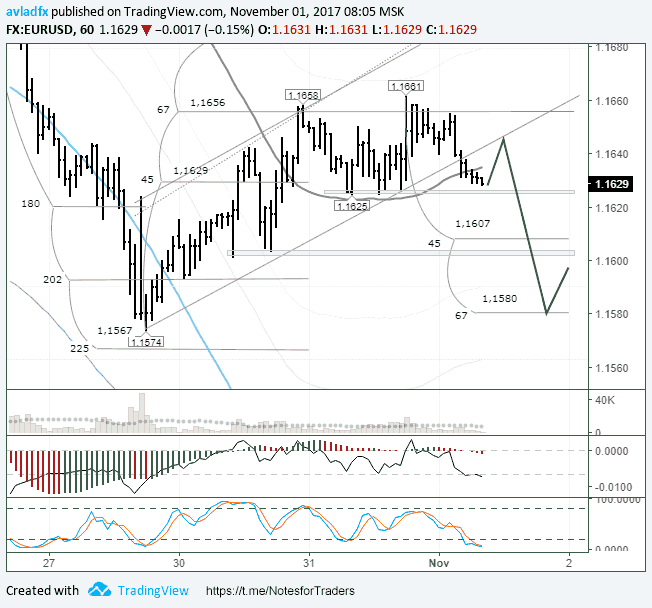

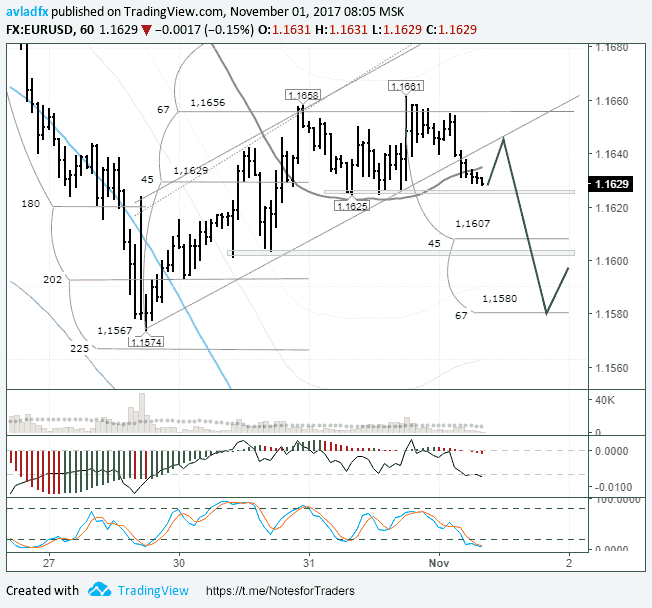

Fig 1. EURUSD rate on the hourly.

Source: TradingView

Due to low seller activity, the euro’s upwards correction continues. The 67th degree is acting as a resistance for buyers. During trading in Asia, the price, having broken through 1.1638, exited the upwards channel. At the time of writing, the euro is trading at 1.1626 (-35). This marks a 0.14% drop against the dollar.

Traders are proceeding with caution ahead of the upcoming Federal Reserve meeting in the US. However, there’s no need to worry about this meeting. It’s not one that will be accompanied by a summary of macroeconomic projections or a press conference with Janet Yellen.

Leave A Comment