One of the first lessons of any marketing class is that adding a “+” next to any product automatically infers that the new version is a better version of the old one. So, while FANG was an adequate group of stocks for investors looking to get their fix of the most turbo-charged growth stocks, like every trend or fad, eventually the idea gets stale and consumers need more. So what was a financial marketer to do? Why not take FANG and ad a plus sign!

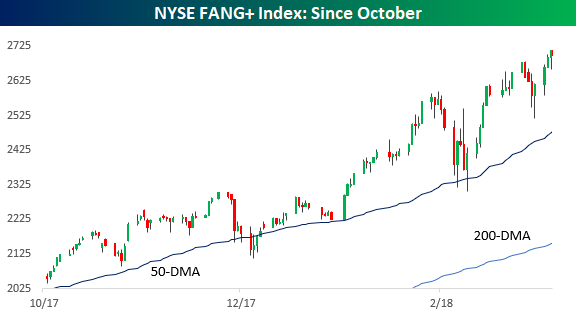

Enter FANG+. While FANG encompassed was simply a combination of Facebook (FB), Amazon (AMZN), Netflix (NFLX), and Alphabet (GOOGL), FANG+ takes those four names and adds in other favorites of the action-seeking trading community like Apple (AAPL), Alibaba (BABA), Baidu (BIDU), NVIDIA (NVDA), Tesla (TSLA), and Twitter (TWTR). Talk about a hyper-growth investor’s dream! Taking a look at the performance of FANG+ since its inception late last year, the index has been on quite a tear with a gain of over 34% since late October.

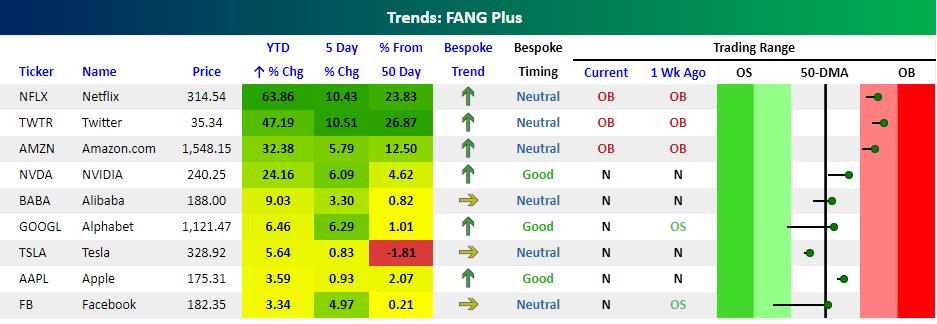

It’s been quite a run. In spite of the fact that the broader market has been up just slightly on the year, every stock in the FANG+ index is outperforming the S&P 500, and four of the stocks are outperforming by a magnitude of more than 10 times! Leading the way, Netflix (NFLX) is up 64%, Twitter (TWTR) is up 47%, and Amazon.com (AMZN) is up over 30%. Given these moves, it should come as no surprise that all three stocks are overbought. The remaining stocks in the index are all in neutral territory, though, and only one (TSLA) is below its 50-day moving average (DMA).NVDA, GOOGL, and AAPL even have good timing scores. Shares of Facebook (FB) and Apple (AAPL) are both up less than 5%, though, so these two better get their act together!

Leave A Comment