Well, there’s not a lot going on in the week ahead and by that I mean there’s so much going on that you couldn’t plan for it even if you wanted to.

Let’s start with the obvious: Robert Mueller is going to indict someone tomorrow and the President is displaying his usual penchant for restraint in the face of adversity:

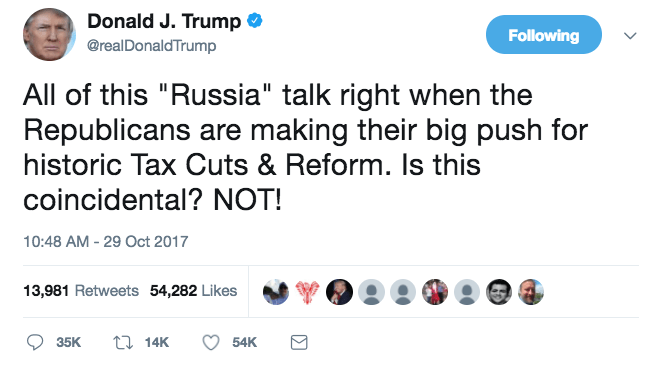

A couple of things there. First, Trump still doesn’t understand what it means to put something in scare quotes. Second, “tax” is not a proper noun. Neither is “cuts”. And neither is “reform”. Finally, he’s right: it’s not coincidental. Because this is what happens sometimes after criminal investigations: people get indicted. Oh, and when was the last time you heard anyone over the age of about 9 use the word “not” in all caps at the end of a sentence?

So there’s that. We’ll also get Trump’s pick for the Fed and in case you weren’t already excited enough about that, he’s released an actual commercial for it. And I mean that literally:

In all likelihood, it will be Powell. That’s the safe choice and I’m sure by now someone has told him that anyone other than Powell or Yellen would throw markets for a loop and he’s unlikely to risk that, as record high stock prices are all he’s got left when it comes to things he can point to as being “great.” Plus, Mnuchin has been lobbying for Powell so that helps. If for some reason he changes his mind at the last minute and picks Taylor, expect a sharp rally in the dollar and higher yields. If he loses his mind completely and pulls a Warsh out of his hat, just go ahead and sell everything and barricade yourself in the basement for the next six months.

Speaking of the Fed, we’ll the get the November meeting this week and barring someone having a senior moment, there won’t be anything new there. If they sent any kind of meaningful signal to markets in the statement, it would be a surprise. Here’s Goldman:

Leave A Comment