Source: Federal Ministry of Finance, photo: Ilja C. Hendel

German Current Account Surplus is Nothing New

With the German current-account surplus coming under scrutiny by the new US administration it is worth considering recent developments within the German trade balance looking at factors which might impact future negotiations between the US and Germany.

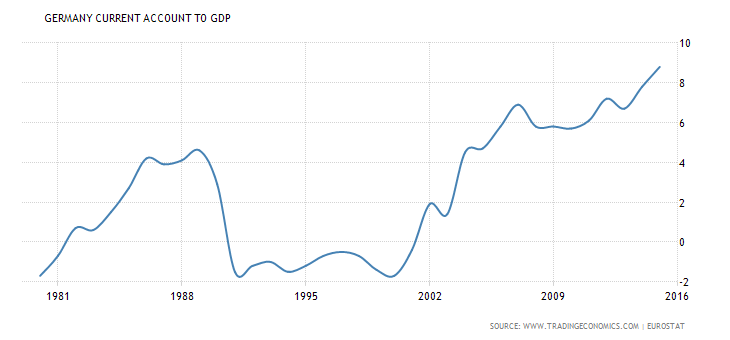

Firstly, it is worth noting that the German trade surplus isn’t new. Before the reunification of Germany in 1990, the surplus stood around 5% of GDP. The economic boom, especially the strong domestic demand fueled by the reunification, caused a surge in imports which weighed on the surplus for a number of years. During the 1990s, Germany also suffered a loss of competitiveness linked to policies aimed at stoking East German incomes up to West German levels. Consequently, Germany ran a current-account deficit between 1991 and 2001.

Current Account Surplus Has Risen Post-Crisis

It was only in the early 2000s that the current-account surplus returned, reaching an average of 8.5% of GDP in 2016. Incredibly, the current account surplus was unharmed by the crisis in 2008/09, despite demand in other European countries being weighed down by the crisis. During this period, exports to countries outside the Eurozone began to rise, compensating for the lack of demand from neighbouring countries, fueling a surge in the German current account surplus.

Germany At Risk Due To Trade Relations

There are three key countries which have been on the other end of Germany’s rising account surplus post-crisis: The UK, the US & China. Regarding China, Germany now runs a small bilateral surplus where previously they ran a large deficit. Germany’s surpluses with the US and UK however reached record highs in 2016. Consequently, not only is Germany at risk from an adverse Brexit outcome but also from the US administration if it decides to take steps to reduce Germany’s surplus.

German Trade Surplus Targeted by the US

Leave A Comment