Toll Brothers stock, one of the largest home builders, is down a whopping 35% from its peak this year as housing prices keep reaching new astronomical heights. The median home price in Tribeca, Manhattan is over $5 Million. Not a problem for Justin Timberlake, but many worry that the wave of Millennials needing homes to start a family can’t afford today’s inflated housing market and that prices may mirror the crash of last decade that shook the globe. While it’s been a lousy year for home buyers and investors in housing stocks, there are some major differences this time that make us more sanguine.

High demand and tight supply equals high prices and incentives more rapid home building. However, the inventory of homes to purchase is very low and falling. This hardly compares to the flood of workers and housing that came on line in 2005-2006. Construction workers are coming back today, but too slowly and still remain a half a million workers shy of their 2006 peak when there was a housing glut. With today’s shortage we may need a million new builders to catch up to Millennial demand or find larger Apartment alternatives for their new families. The multi-family Apartment living is still booming as buyers are cudgeled to a more creative family lifestyle. We will be more alarmed when home inventories move above their 2012 highs.

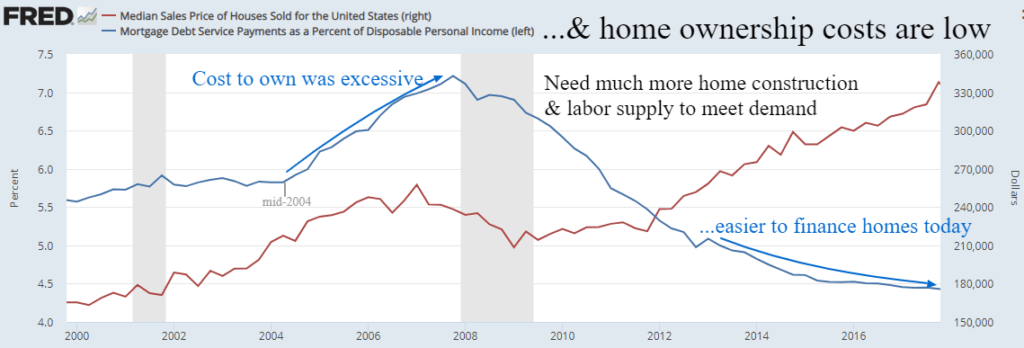

While home prices have surpassed the 2007bubble by another 30% as of 2018, the ability of owners to handle their mortgage debt is excellent. Buyer traffic is very high today despite rapidly rising home prices which normally triggers a flood of new building. Once buyers start living beyond their means with debt payments above 5.5% of their income, then we’ll be more concerned.

Mortgage default rates remain very low, distressed property sales are absent and more buyers are able to qualify with adequate cash to purchase their real estate.

Leave A Comment