The Fed hiked today, first quarter weakness aside and second quarter weakness aside. There was one dissent.

The only surprising thing in their boilerplate statement was a lack of the word “transitory”.

Derivations of “moderate” constitute the new buzz-word.

Spotlight on Moderate and Balanced

The Fed failed to mention weakness is transitory. There was no mention of retail sales, construction, housing or any of the other string of 18 poor hard data economic points in the second quarter.

Has the economy already transitioned from a first-quarter transitory weakness setup to a moderate, risk-balanced second-quarter setup?

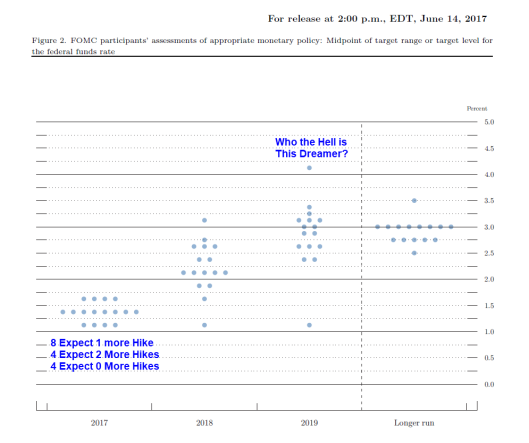

Dot Plot

The Dot Plot is from Federal Reserve Board and Federal Open Market Committee release economic projections from the June 13-14 FOMC meeting.

The dot plot is the interest rate expectation of Fed participants. Only one sees weakness as not being transitory.

For an 18-point synopsis of second-quarter weak data points, please see Yellen Still Clueless?

Leave A Comment