Fed offers up a stock market beatdown

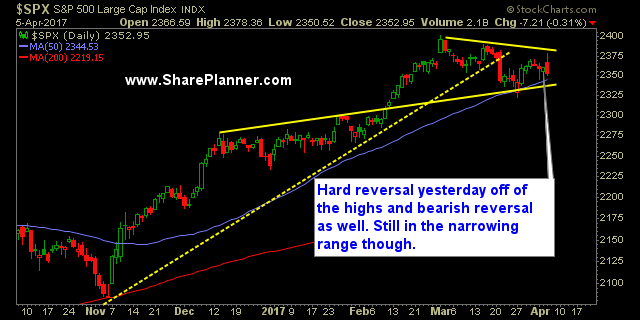

I don’t get all the annoyed by the stock market all that much. Sure it can do things that will make you scratch your head, but yesterday’s manufactured afternoon sell-off coming from the Fed proclaiming that stock prices were a bit too high, was not something I was thrilled about. That is because, as a person who follows charts, yesterday’s rally was strong and trending higher nicely. Then you get a comment in the Fed Minutes and it causes the algos to go completely awry.

Am I going to mope about it? No. Instead, I am going to move on. Move on to the next trade and manage those trades that I am currently in. Things like what happened yesterday is part of trading. It doesn’t follow along the lines of technical analysis, and that can infuriate a trader, but technical analysis provides us with a guide, not absolutes.

But here is one absolute I can give you. Despite the sell-off yesterday, the S&P 500 is holding the 50-day moving average still. That continues to be a rising level of support that provides a catalyst for the bulls and an impenetrable wall for the bears. So keep that in view as you head into today.

S&P 500 Chart

Current Stock Trading Portfolio Balance:

2 Long positions

Recent Stock Trade Notables:

Las Vegas Sands (LVS): Long at 57.24, closed at 56.53 for a 1.2% loss.

UPRO: Long at 91.94, closed at 96.54 for a 5.0% profit.

Alibaba Group (BABA): Long at 105.736, closed at 108.22 for a 2.4% profit.

Facebook (FB): Long at 134.27, Closed at 139.23 for a 3.7% profit.

CDW Corp (CDW): Long at 58.65, closed at 58.91 for a 2.7% loss.

Redhat (RHT): Long at 82.41, Closed at 83.53 for a 1.4% profit.

Ambarella (AMBA): Long at 57.15, Closed at 55.52 for a 2.8% loss.

Alibaba Group (BABA): Long at 104.73, closed at 106.05 for a 1.3% profit.

Broadcom (AVGO): Long at 218.63, Closed at 222.71 for a 1.9% profit.

American Airlines (AAL): Short at 44.76, Closed at 44.03 for a 1.6% profit.

UPRO (Day-Tade): Long at 95.35, closed at 96.50 for a 1.2% profit.

OZRK: Long at $56.12, closed at $54.69 for a 2.5% loss.

FNSR: Long at $34.25, closed at 34.70 for a 1.3% profit.

UPRO (Day-Tade): Long at 96.92, closed at 98.03 for a 1.2% profit.

JP Morgan Chase (JPM): Long at 87.21, closed at 89.67 for a 2.8% profit.

Chevron (CVX): Short at 110.03, covered at 111.85 for a 1.6% loss.

Flex Technologies (FLEX): Long at $15.62, closed at $16.57 for a 6.1% profit.

Baidu (BIDU): Long at $174.70, closed at $187.00 for a 7.0% profit.

Ollie’s Bargain Outlet: Long at 33.20, closed at $32.50 for a 2.1% loss.

Corning (GLW): Long at $26.98, closed at $27.45 for a 1.7% profit.

Illinois Tool Works (ITW): Long at $127.74, closed at $129.86 for a 1.7% profit.

Marriott Int’l (MAR): Long at $86.16, closed at $87.51 for a 1.6% profit.

Leave A Comment