Image Source: Pexels

Image Source: Pexels

Stocks are attempting to recover from recent selloffs as market players engage in aggressive dip buying of technology shares. Positive earnings reports from Amazon and Intel are certainly helping the bull case. Economic data this morning, meanwhile, depicted a consumer whose pace of spending exceeded income by a wide margin. The consumer spending, unfortunately, fueled inflationary pressures, with the Fed’s preferred inflation gauge, the Personal Consumption Expenditures Price Index, rising to a five-month high.

Spending Spree Continues

Consumers rushed to purchase goods and services last month, according to this morning’s Personal Income and Outlays report from the U.S. Bureau of Economic Analysis. Consumer spending rose a sharp 0.7% month-over-month (m/m), much higher than the 0.5% expectation, and eclipsed August’s 0.4% increase. Income only rose 0.3% m/m, missing expectations, however, and signaling that consumers drew down savings and added debt to their balance sheets to fuel spending. Income dropped from the previous month’s 0.4% rate of growth and fell below the consensus estimate for an unchanged rate. Indeed, the personal savings rate fell to 3.4%, the lowest level since last December.

Relentless Consumers Drive Up Inflation

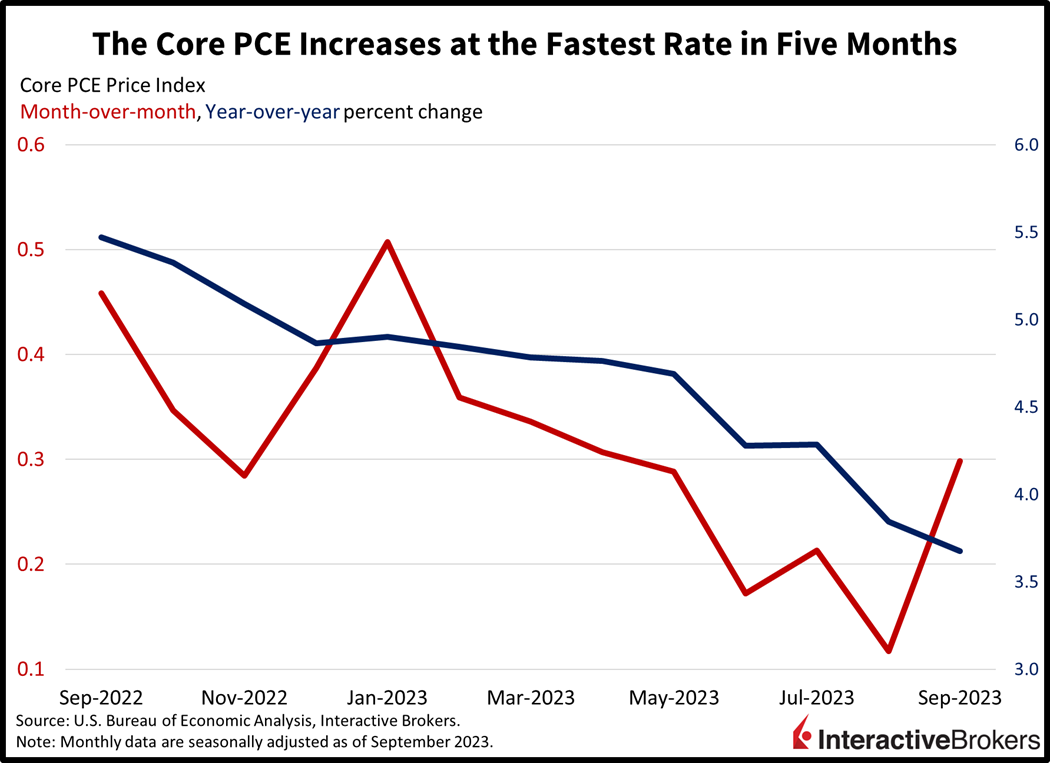

While retailers may be rejoicing as consumer spending surges, the news is likely to give members of the Federal Reserve angst as they continue to fight stubborn inflation, driven, in part, by strong shopping. The core PCE Price Index increased at the fastest pace since April, rising 0.3% m/m and arriving in-line with expectations while accelerating significantly from August’s 0.1% rate of change. The overall PCE Price Index, which includes food and energy, rose 0.4% during the period, faster than the 0.3% projection and unchanged from August’s pace. On a year-over-year (y/y) basis the PCE price indexes met expectations with overall prices rising 3.4% while the core segment core rose at a pace of 3.7%, compared to 3.4% and 3.8% in August.

Price pressures were led by the following categories which increased at the noted m/m rates:

Relief Rally in Stocks

Markets are generally positive today as technology leads the charge higher while bond yields and the dollar cooperate marginally. The tech-heavy Nasdaq Composite Index is leading the pack, with values rising 1.4% while the S&P 500 Index gains 0.3%. The cyclically tilted indexes, namely the small-cap Russell 2000 and Dow Jones Industrial Average are down 0.3% and 0.2%, meanwhile. Sectoral breadth is mixed, with the consumer discretionary, technology, materials, communication services and industrial sectors higher while the other six major sectors are lower. Bond yields are slightly higher on the long-end but close to the flatline at the short-end with rates on the 2-year Treasury maturity down 1 basis point (bps) to 5.04% while the 10-year is up 2 bps to 4.87%. The Dollar Index is down 25 bps to 106.35, meanwhile, as the greenback loses value relative to the euro, pound sterling, yen and Aussie dollar while it gains versus the yuan, franc and Canadian dollar. The Federal Reserve’s currency is still on track for its third monthly gain, however. WTI crude oil is up 21 cents or 0.25% to $83.66 per barrel as U.S. majors Chevron and Exxon disappoint on their bottom lines. The result is bringing in energy bulls that marginally expect lighter production volumes from the aforementioned in efforts to maintain margins.

Consumers Continue to Avoid Big Ticket Items

Consumers are struggling with higher credit card debt levels, increased interest rates, elevated costs and reduced credit availability. In this environment, durable goods prices fell 0.1% during the period.Businesses are reporting mixed results for consumer sales as illustrated by the following examples:

Bad News is Good News?

Real-time data is depicting softening economic conditions and setting the stage for potentially weaker-than-anticipated economic data next week, including the nonfarm payroll report. The result may cause bond yields to decline and ignite a market rally through the end of this year. I estimate that the Consumer Price Index for this month will climb only 0.1%, which would coincide with economic weakness resulting, in part, from crude oil prices dropping 10%. This decline could easily reverse if geopolitical conditions don’t cooperate but fingers crossed for now. In the meantime, core inflation is sticky, driven by relentless services spending in labor intensive industries.More By This Author:Mr. Market Plays Survivor Plus AMZN ExpectationsWhat If The Mag Seven Becomes The Big Five? + It’s Meta’s Turn Options Market Expectations For Microsoft And Alphabet

Leave A Comment