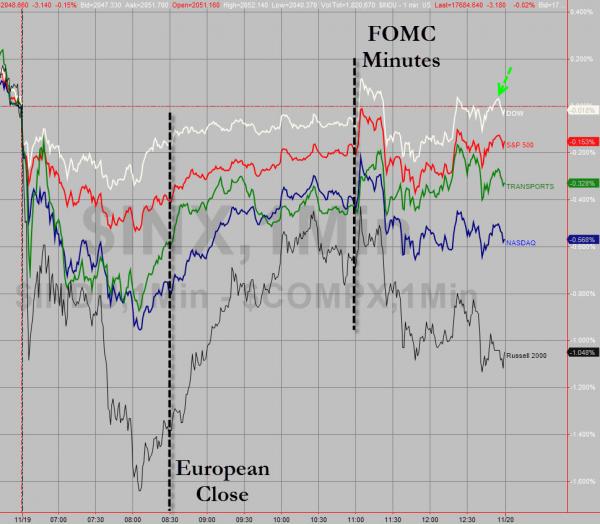

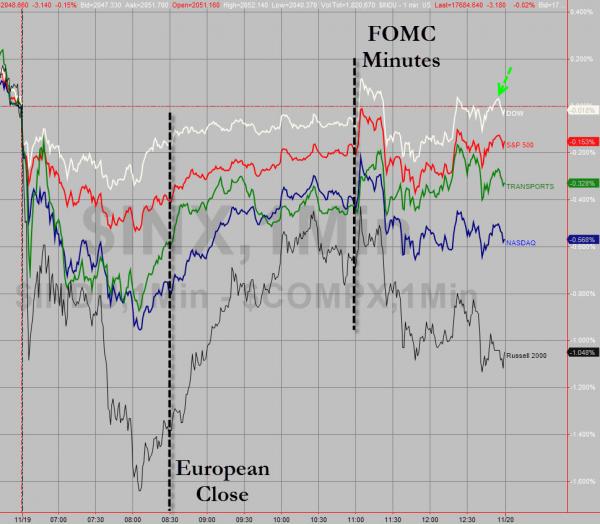

The word “volatile” comes to mind when reflecting on today’s cross-asset class action. US equities dumped into and beyond the US open, decoupling entirely from JPY carry, only to reverse perfectly at the European close and recover all the way back to USDJPY right as the FOMC minutes hit. A kneejerk sent stocks higher but that quickly decoupled also and stocks fell. Small Caps underperformed and are back in the negative year-to-date. Treasury yields were volatile, ramping higher into the US open, rallying post, then whipsawing on FOMC minutes to close 3-4bps higher on the day.The USD was flat on the day despite the surge in USDJPY back above 118. Commodities were a mess with a big dump on Swiss Gold polls, rip higher on Russian buying rumors and dropped again on FOMC (oil and copper followed suit). HY Credit was “bidless” and continues to decouple from stocks (along with VIX). The Dow was levitated back into the green to close

On the day, Russell 2000 underperformed… and they tried their best to get The Dow green to prove how The Fed is right…

The Russell 2000 was down 1.8% this week, down 1.5% today, and had limped ungraciously back into the red for the year. before bouncing back into the FOMC Minutes release. Since then, it retreated rapidly and is now once again negative for 2014… which is odd given everyone proclaiming growth is back and the domestic economic exposure bias of small caps over big caps…

JPY Carry has decoupled…

HY Credit notably decoupling from stocks still

As Brean Capital’s Peter Tchir notes:

I have said since it happened it was particularly focused on the high yield market which had gone bidless and rather than finding real clearing levels they did the QE trick (it was more about hy then stocks). Today they admit the market was right to take their reaction as stepping in when vol increased. By adding the statements about misimpressions today they are resetting the Yellen put – to a lower strike. The bad thing is hy is weak again and it isn’t just shale and CCC that is going bidless – there is almost a daily blow up now whether here or in Europe.

Leave A Comment