In my post of December 29, 2015, I stressed the importance of the Financials ETF (XLF) in, potentially, propelling the SPX to an increase of 5-6% for 2016.

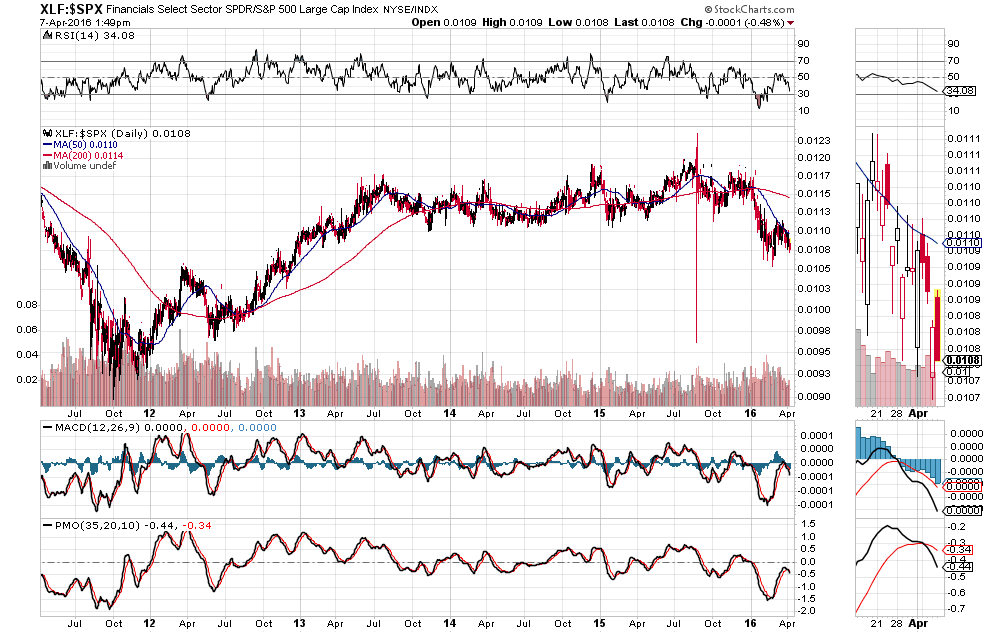

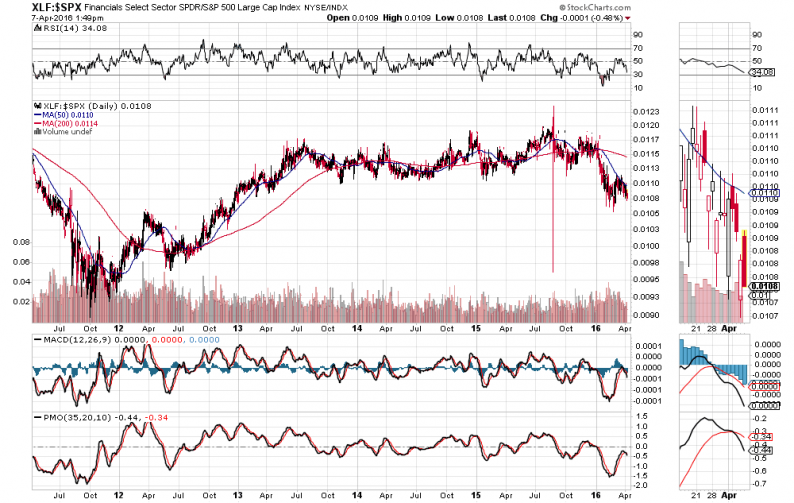

You can see from the Daily ratio chart below of XLF:SPX, that price weakened considerably afterwards and fell to new lows not seen since 2012. Price is attempting to stabilize above that low, but all three indicators are still in downtrend and display new “SELL” signals, and price action is still under the bearish influence of the Death Cross formation of the moving averages.

If price drops and holds below near-term support of 0.0105, we could see a significant drop in the SPX, likely to new lows for the year, as I mentioned on April 3.

Leave A Comment