My Swing Trading Approach

Still long on the market. I dabbled to the short side some yesterday, it didn’t work. Now that is out of my system, I remain long and will look to add 1-2 new positions today on market strength.

Indicators

VIX – Pretty much flat yesterday, but that is quite impressive when you consider it dropped 17% from its intraday highs of 11.77 down to its closing price of 10.05.

T2108 (% of stocks trading below their 40-day moving average): Sill finished lower for a fifth consecutive day, down 1.6% to 66%. Still a healthy number for this bull market.

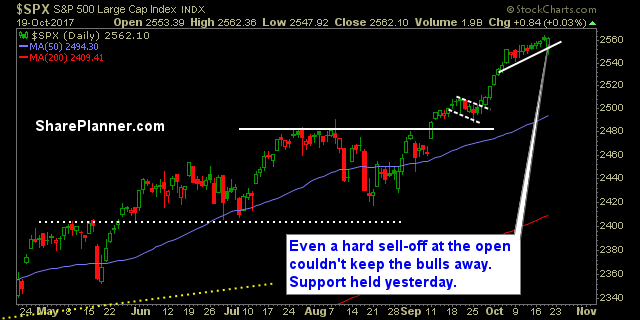

Moving averages (SPX): 5-day and 10-day moving averages broke early on, but managed to close above them, before the end of the day.

Industries to Watch Today

Utilities led the way yesterday. Financials looking to breakout of recent consolidation. Consumer Defensive and Technology were by far the weakest areas of the market yesterday. Energy looking to roll over.

My Market Sentiment

I thought yesterday that the weakness would persist and the longs would get washed out. Initially it looked that way, but the dip buyers stepped in and rallied the market back into the green. Impossible market environment for the bears to succeed in.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Recent Stock Trade Notables:

Leave A Comment