Monday, January 25

Tuesday, January 26

Wednesday, January 27

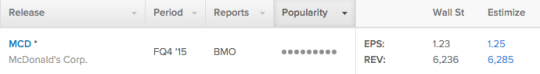

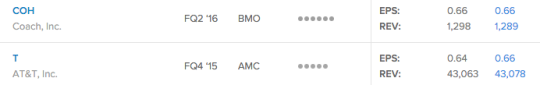

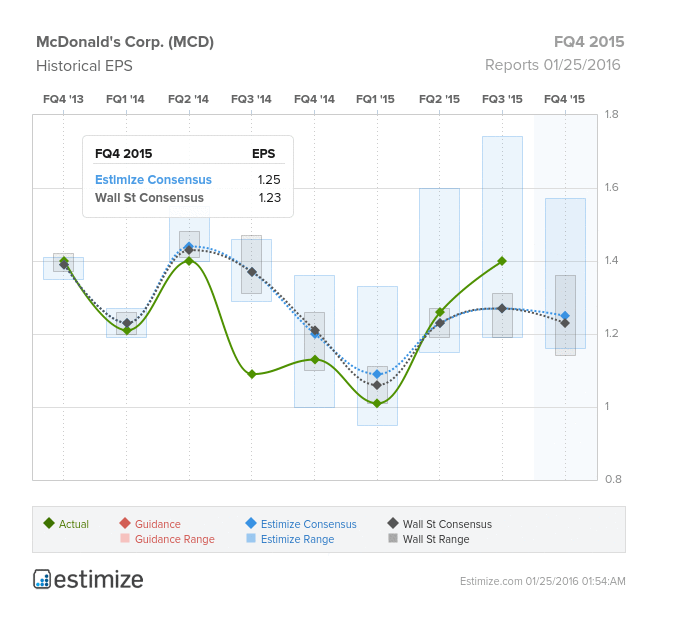

McDonald’s (MCD)

Consumer Discretionary – Hotels, Restaurants & Leisure | Reports January 25, before the open.

The Estimize community is looking for EPS of $1.25 as compared to the Wall Street consensus of $1.23. Revenues are also slightly higher with an Estimize Mean of $6.29B vs. the Street’s $6.24B.

What to Watch: Despite losing market share to the rapidly growing fast-casual sector, McDonald’s posted better than expected third quarter results. The fast food giant has likely been a beneficiary of the struggles Chipotle faces with multiple E. coli outbreaks. Meanwhile, the quick service restaurant is trying to reposition itself through new menu offerings, marketing strategies and global expansion. In mid 2015, McDonald’s restructured operations into 4 segments combining markets with similar needs, challenges and opportunities for growth. These include the United States,mature markets, higher growth markets and foundational markets. So far this has paid off as share prices rose 27% over 2015 with the company poised to close the fiscal year strong. Read more about what we’re expecting for MCD.

Coach (COH)

Consumer Discretionary – Textiles, Apparel & Luxury goods | Reports January 26, before the open.

The Estimize consensus calls for EPS of $0.66, in-line with Wall Street’s estimate. On the other hand, revenues expectations from Estimize are slightly lower at $1.289B, $10M below the Street.

What to Watch: In a surprising turn of events in 2015, Coach began to outpace its fiercest competitor, Michael Kors, in the so-called “handbag wars.” During the holiday season, Coach managed to have better sales than KORS, something that will be reflected in Tuesday’s report. The company has been undergoing a brand transformation as it reinvigorates its product lines and store aesthetics. A major part of this restructuring has been focused on acquisitions, such as that of Stuart Weitzman a year ago, as Coach looks to become a multi-brand company. For the last two quarters COH has slightly beat estimates on the top and bottom-line, but is still expected to continue its streak of negative YoY EPS growth. On the bright side, revenues are anticipated to increase 6% YoY for their FQ2 2016, the first positive growth rate in nine quarters.

Leave A Comment