For all the traders and hedge fund managers who are under 30, Amazon (AMZN) has been here before, and not just once: a place where the company’s growth prospects – perceived as virtually boundless – were put into question, leading to a collapse in the soaring stock price.

Indicatively, putting the company’s “valuation” in context, AMZN is now trading at a PE of roughly 460x, which compares to 87x during the last peak in the summer of 2008.

But what matters for Amazon has never been earnings: it was always top line growth (the company generated $107 billion in sales in 2015 and less than a billion in net income) and multiple expansion (or contraction).

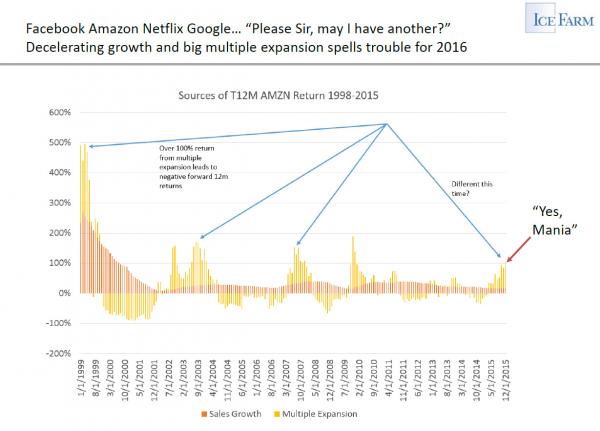

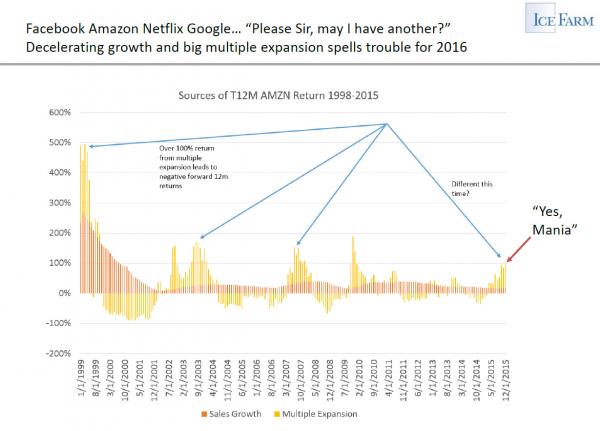

Putting all that together we get the following chart courtesy of IceFarm Capital: 16 years of sales growth since the first dot com bubble superimposed on top of AMZN’s multiple expansion (or contraction). In the latest quarter, worldwide net sales growth once again took a leg lower despite AMZN now employing over a quarter million workers!

But the real question is what will the market do: will it continue giving AMZN’s multiple the benefit of the doubt, and let it grow at its recent torrid pace – a pace we have seen many times before – or will the market sniff out that as a result of the global growth slowdown the time to exit has arrived, and lead to an outcome we have also seen many times before, when AMZN’s multiple growth suddenly went into reverse sending the stock price plunging as a result.

If the answer is yes, watch out below.

Leave A Comment