The following data cover the latest from the CFTC’s Commitment of Traders as reported by Oanda from the week of Monday, March 21, 2016. From Oanda:

“The Commitments of Traders (COT) is a report issued by the Commodity Futures Trading Commission (CFTC). It aggregates the holdings of participants in the U.S. futures markets (primarily based in Chicago and New York), where commodities, metals, and currencies are bought and sold. The COT is released every Friday at 3:30 Eastern Time, and reflects the commitments of traders for the prior Tuesday.”

In this edition of “Forex Critical”, I focus on notable changes in the currency positioning of non-commercial traders, also known as speculators. While speculators do not necessarily drive market action, they can provide good proxies for the market sentiment that DOES drive currency moves. Wherever meaningful, my snapshots of currency charts show U.S. dollar currency pairs to provide a common point of reference and a direct comparable to the charts provided by Oanda (the yellow line in the positioning charts). These charts come from FreeStockCharts.com. I provide Oanda’s embedded tool at the end of this post for your convenience.

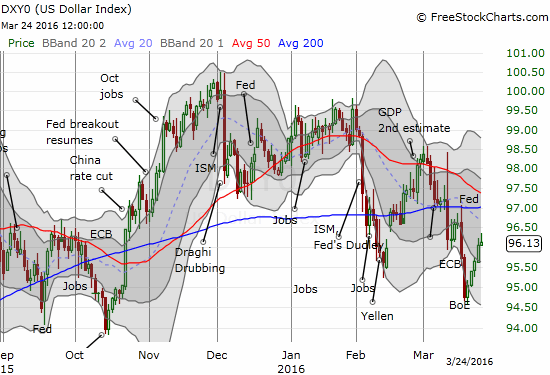

The U.S. dollar index

For context, the U.S. dollar index (DXY0) has been recovering since a huge two-day post-Fed loss. The index reversed half its loss in a little over three days. Perhaps within 2 or 3 days, all losses will get reversed. Expectations on rate hikes are a likely driver. After the Fed’s March announcement, expectations for the next rate hike dropped from July to September. Those expectations are now back to July.

The U.S. dollar index is trying to recover from its post-Fed losses.

Across most of 2016, expectations for the next rate hike are slowly returning to levels last seen right before the Fed announced its latest policy on March 16th.

The British pound

Perhaps the previous week’s plunge in net short interest on the British pound (FXB) was a random blip. THIS week, speculators are suddenly back in the game betting against the British pound. They clearly seized upon the previous week’s surge in the pound off the Bank of England’s (BOE’s) statement on monetary policy as an occasion to refresh shorts at a better price. This quick shift and re-shift reminded me to avoid over-extrapolating one week moves. The bias for speculators remains heavily against the British pound.

Leave A Comment