Despite last Friday’s pullback, nearly all markets have been heading higher with no end in sight.

Market strategist John Roque at Key Square Capital Management recently spoke with Financial Sense Newshour to discuss his outlook and a number of risks building under the surface.

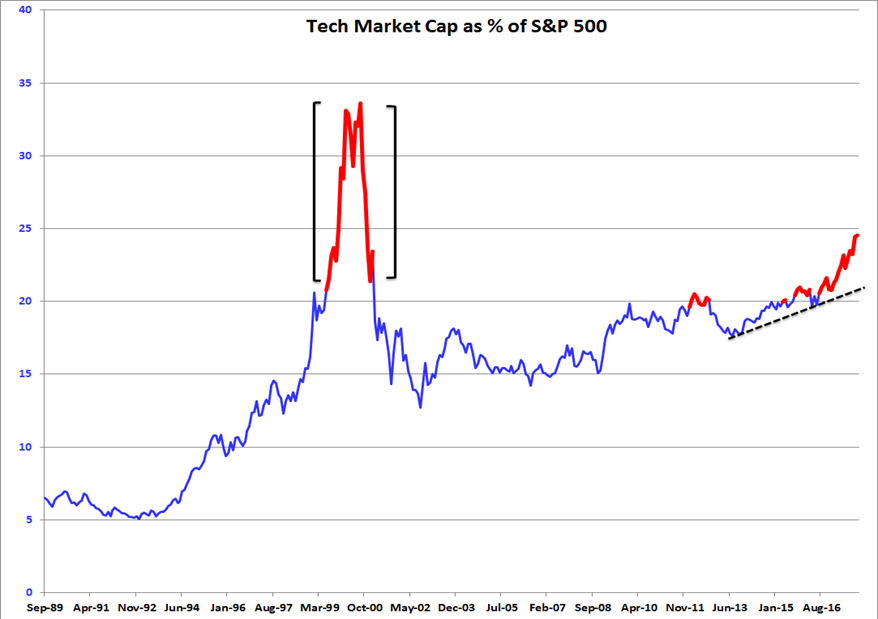

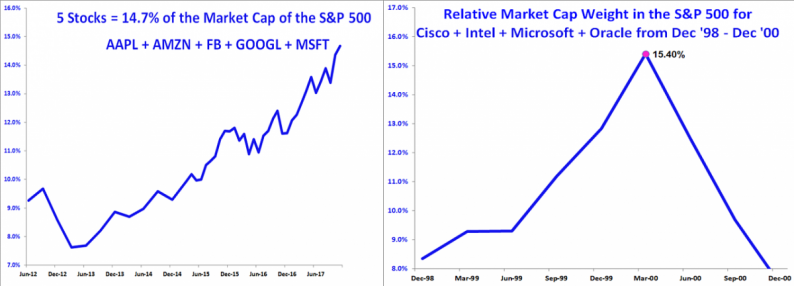

Tech Market Concentration

The former strategist for Soros Fund Management said even though bears have been wrong for years and it’s pretty hard to fight the upward trend, we do see high levels of concentration that are concerning.

For example, if you look at Apple, Amazon, Facebook, Google, and Microsoft, they now make up almost 15% of the S&P 500. At the 2000 peak, Cisco, Intel, Microsoft, and Oracle made up 15.4%.

It we look at technology’s market cap in the S&P 500 as a whole, it is currently around 25%. This is still short of the all-time high during the tech bubble, but still puts us well within the ’99-’00 period.

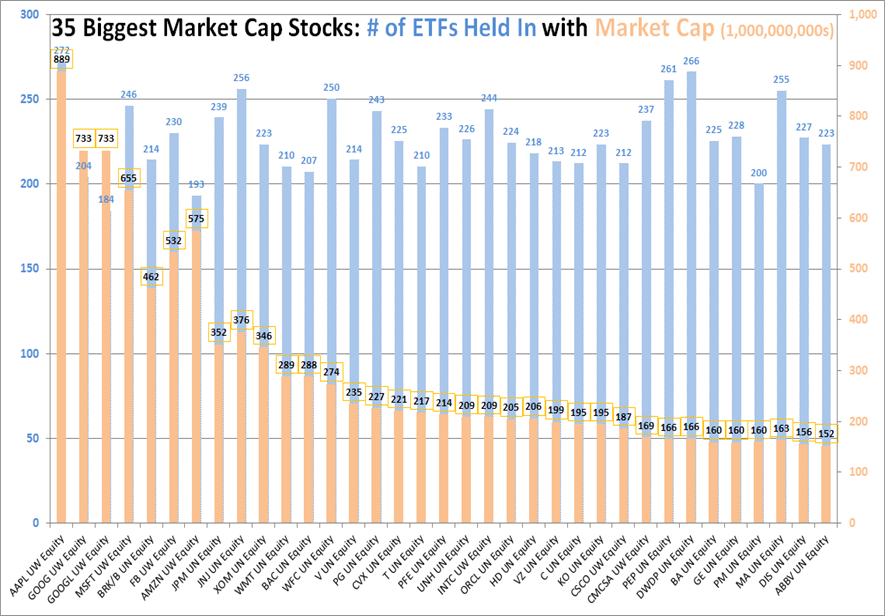

The Role of ETFs and Passive Indexing

What is driving this trend of increasing market concentration?

Roque suspects that as much as 85% of volume on the New York Stock Exchange is now driven by passive investing through ETFs, which tend to be dominated by the same large-cap stocks.

As an example, Roque pointed listeners to the following chart where we see the 35 biggest market cap stocks all being held by hundreds of ETFs.

“If that’s the case, it makes sense for me to continue to pay attention to the biggest stocks because they require the lion’s share of that volume in a particular ETF,” Roque said. “These are the drivers of any market move, and we won’t know how the market behaves until these stocks deteriorate.”

In addition to gold, market valuations, and various sectors like financials, Roque also discussed Japan’s stock market, the Nikkei, which he is the most positive one.

Leave A Comment