My Swing Trading Approach

I closed my swing-trades in JEC at $76.80 for a +3.8% profit and CRM at $158.60 for a +3.1%profit. I am open to adding another long position today should the market cooperate and allow for it. Yesterday’s sell-off creates some concern as to whether a rally can be sustained here.

Indicators

Sectors to Watch Today

Discretionary led the market higher for the first time in a very long time. Could see a break out of its sideways channel today. Staples traded higher, but still appears to be trading lower in the weeks ahead. Healthcare continues to make new all time highs, but intraday, it is giving up most of its gains. False breakout for Technology yesterday. Will need to fix that today, otherwise, profit taking in that sector may result. Utilities breaking down – stay away unless shorting.

My Market Sentiment

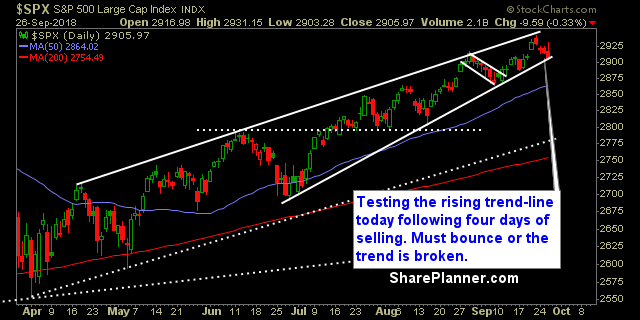

Four-day pullback yet again, very similar to the one that we saw earlier this month. Price will have to bounce on the S&P 500 today or the trend-line off of the June lows will have been broken. Key day for the market going forward.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Leave A Comment