In the words of CEO Elon Musk, the past few months have been “excruciating” for the luxury electric car manufacturer, Tesla. Shares have been down by over 35% since the beginning of the year, compared to the S&P 500, which has been down 10%. Tesla investors have been concerned about Tesla’s ability to compete with larger auto companies, the major question being whether or not Tesla could feasibly scale up their production. The company has been slow to roll out its new crossover SUV, the Model X and many analysts believe that low oil prices have made the electric car less appealing.

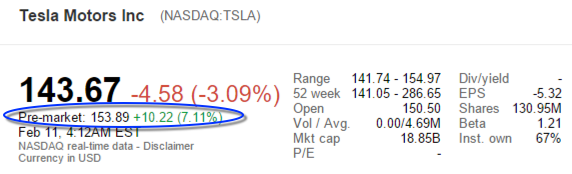

Furthermore, the company has been burning cash at an alarming rate; their cash reserve has fallen by $700 million since December 31st, and the company has burned $2.9 billion of cash in the past six quarters. With the company’s shares in apparent free-fall, it has been easy for many people to write off the company as a lost cause. However, the recent fourth quarter results and analyst conference have shown that Tesla is committed to long-term success, fueling hope among investors causing the company’s stock to shoot up in pre-market trading.

( Source: Google Finance )

The actual numbers for the fourth quarter were not particularly great. The company posted a net loss of $320.4 million for the quarter, almost double what it lost in the previous quarter, and making it 11th consecutive quarterly loss for the company. For the year 2015, Tesla posted a loss of $889 million, or $6.93 a share. Fourth quarter revenue increased by 27%, from $956.6 million to $1.21 billion. Tesla’s revenues actually missed the estimates of analysts polled by FactSet, who expected revenues of $1.85 billion.So, considering that Tesla reported losses, continued to burn cash, and missed analyst expectations what exactly caused the stock to increase so much last evening? The answer lies in Elon Musk’s forward outlook. The CEO explained in yesterday’s quarterly conference call “I feel very good about things right now.”

Leave A Comment