It’s Friday in the Wall Street DailyNation. And that means we’re ditching our regular routine of commentary-based articles. Instead, we’re using charts to present some important investment and economic insights.

This week, we’re tackling the pesky debate about Tesla’s valuation and the Great Retail Apocalypse of 2017.

And of course, we’re sharing ways to profit from each. Don’t miss the opportunities!

The Absurdity of Tesla

In early March, we covered Bitcoin’s historic breakout. For the first time ever, the cryptocurrency traded higher than one ounce of gold.

Big whoop? Not really. But I digress…

This week, we’re covering the historic breakout of electric carmaker Tesla (TSLA).

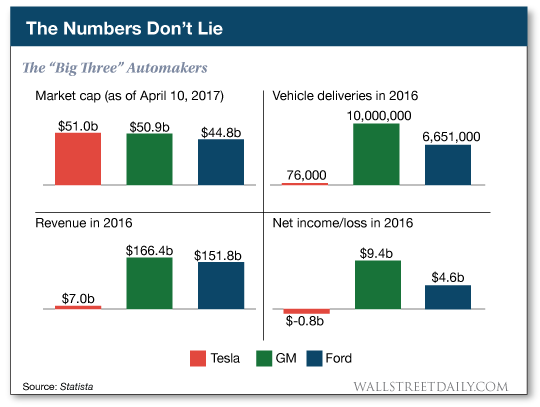

For the first time ever, the company’s market cap (briefly) surpassed General Motors (GM), to become the most valuable car company in America, at $51 billion.

Way back in December 2013, a younger, scruffier Lou deemed Tesla’s valuation at $18 billion “absurd” on CNBC’s Closing Bell. My on-air adversary, The Motley Fool’s Matthew Argersinger, reminded me of my bold denouncement this week on Twitter as the company rallied north of his $50-billion market-cap prediction.

Touché. But I still think Tesla’s valuation is “absurd.” And the data still back me up.

Tesla still hasn’t generated a profit — 10 years into its existence. The company produces a fraction of the number of cars that GM and Ford produce, so its revenue lags way behind. Not to mention the company’s heavily indebted, too.

So based on every conceivable traditional metric, the company fails to stack up.

What’s driving Tesla’s current valuation, then?

Hope.

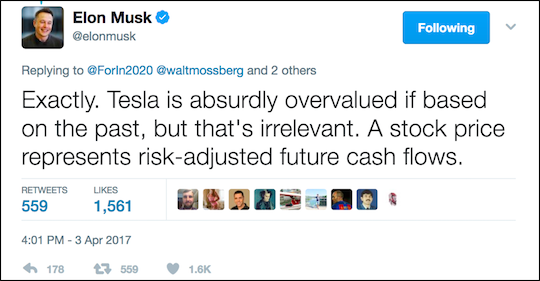

Elon Musk even admits it.

Bidding up shares on the future potential works fine during rip-roaring bull markets. Not so much when the stock market takes a turn to the south. And it’s only a matter of time before the latter happens.

Leave A Comment