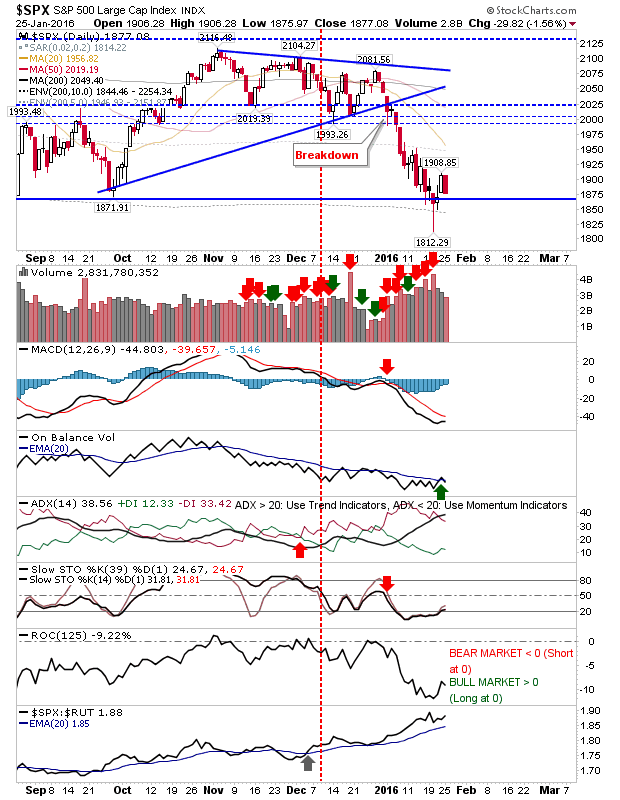

It looks like longs weren’t prepared to wait for a test of Oct-Dec trading ranges before dumping their positions. Instead, longs took advantage of nascent strength to sell existing positions. If there was a bullish take from this, then it’s that selling volume was lighter, which may give bulls something positive to hold on to.

What today’s action suggests is that a move back to last Wednesday’s spike lows would appear to be necessary to firm if support – if such support exists. Unfortunately, such a test would break up September’s low as trading range support, and open up the possibility for a measured move lower (i.e. the height of the Sep/Oct – high/low differential, projected lower).

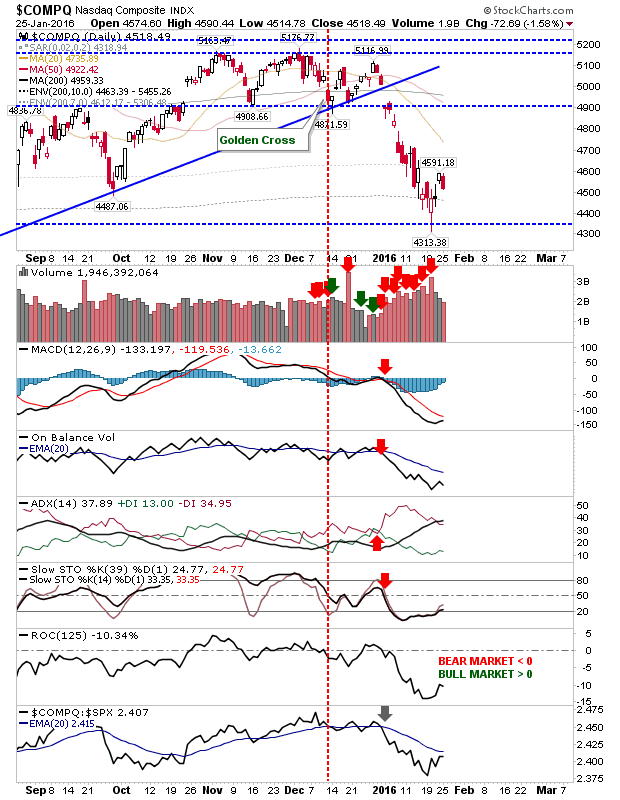

The Nasdaq also registered a 1.5% loss. It too is looking like a January swing low test is on the cards.

The Russell 2000 experienced the heaviest loss, handing over 2% of losses and stalling at resistance. It’s going to take more to generate a ‘bear trap’. For now, bears are in control.

Today will likely have pushed potential buyers back to the sidelines. Many will wait for a retest of last week’s lows to jump, and it’s hard to see buyers wanting to commit before then.

Leave A Comment