Thank God it was Friday, as after the disappointing Retail Sales, weaker-than-expected CPI and bank earnings, most likely needed a drink. (Personal choice on a hot summer night is Tanqueray® Rangpur & tonic with cucumber, lime, and some shaved ginger.)

Retail Sales

Retail Sales missed for the second month in a row and were down 0.2 percent month-over-month after a (revised) 0.1 percent decline in May. That’s the first time we’ve seen sales contract for two consecutive months since September and October 2015. Q2 real retail sales are growing at just 1.25 percent annual rate, which is less than half the average quarterly rate of 2.7 percent we’ve seen since the start of the recovery – where is that accelerating growth? The post-election bump looks to have worn itself out.

Further emphasizing our Connected Society theme, retail sales for Brick and Mortar were up just 2.85 percent year-over-year with Online more than tripling that rate at 9.2 percent year over year. Last week Amazon took that trend to a whole other level, with its Prime Day sales up 60 percent from last years to sit somewhere in the $500 to $600 million range.

Restaurant sales have now been flat to negative in four of the past five months, which we see as a significant indicator of household spending intentions as going out to dinner is one of the first and easiest things to cut from the household budget. We are also concerned to see that Clothing Sales have now been down for two consecutive months as that jars with the Employment Growth data: typically these two are positively correlated as most want to look nice for their first day on the job. Perhaps some of the lack of spending has to do with just how earlier spending has been financed.

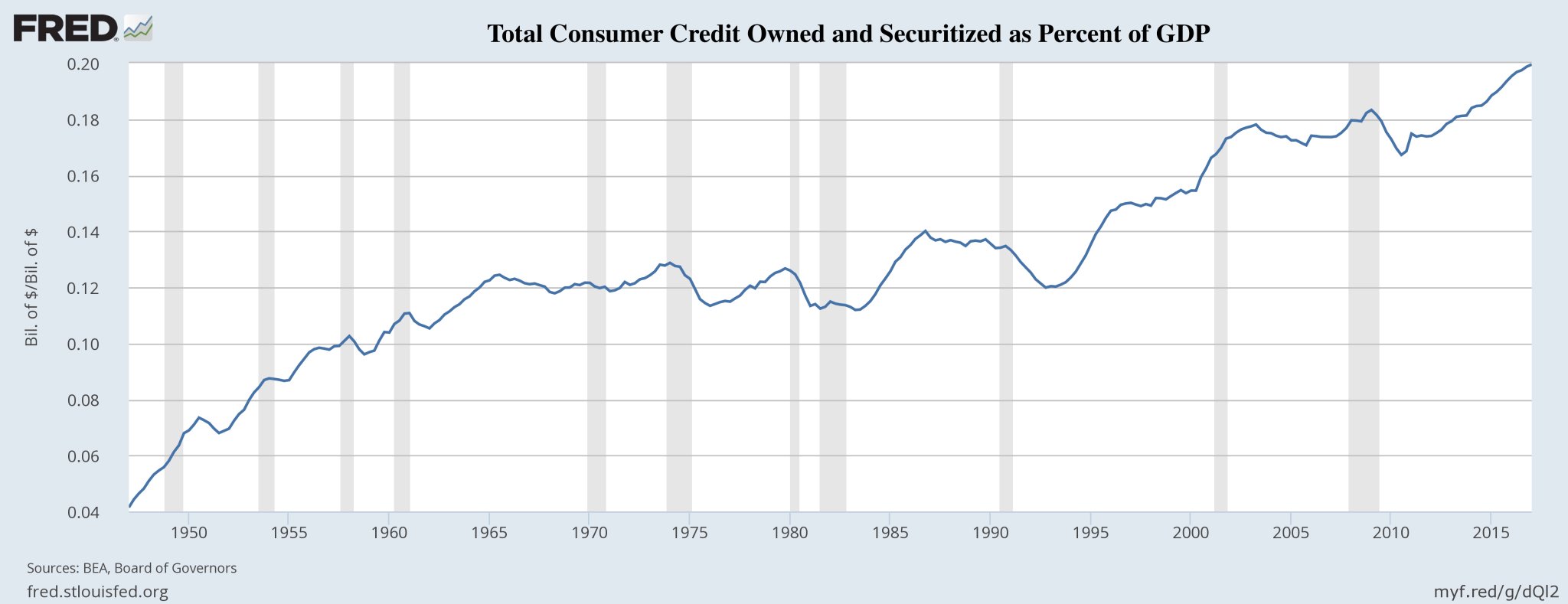

Spending can increase only through growing incomes or growing debt.

Well, not that isn’t exactly a sustainable way to grow spending! Explains a bit about why we are seeing savings rates rise.

Leave A Comment