My Swing Trading Approach

I added one new swing-trade position to the portfolio on Friday. I will raise the stop-loss to protect profits, and if the market can add to Friday’s gains, I will look to add more long exposure. Getting short is still on the table.

Indicators

VIX – Bears stepped in and crusted volatility on Friday, driving it down almost 13%, back below 20, to 19.59. Bearish engulfing pattern over the last two trading sessions.

T2108 (% of stocks trading below their 40-day moving average): Dipped into the teens and immediately found support. Monster rally off the lows, to finish 13% higher on the day, at 27%. Potential for a bottom here.

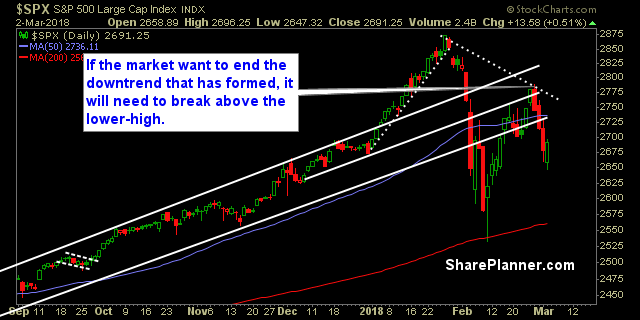

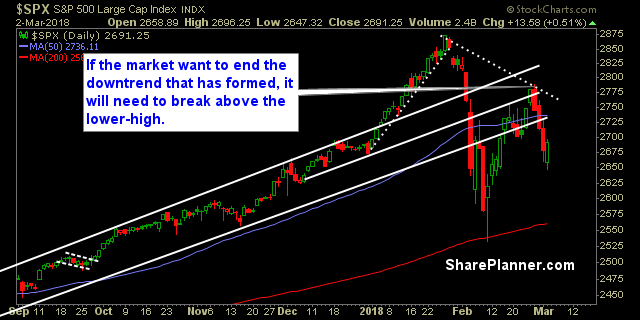

Moving averages (SPX): Unable to break through the 20-day moving average, while holding the rising trend-line off of the 2016 lows. Only trading above the 200-day MA right now.

Industries to Watch Today

Healthcare and Technology led the way higher on Friday. The latter looks poised to test all-time highs once again. Defensive and Energy attempting to put together a double bottom pattern.

My Market Sentiment

Friday saw a sharp reversal-off of its intraday lows and garner buying interest to take the market from trading in the deep-red, and back into the green. Typically this can lead to a multi-day bounce that inspires traders to buy the dip aggressively.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Leave A Comment