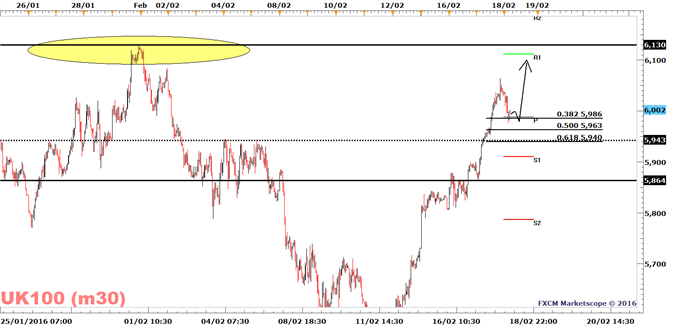

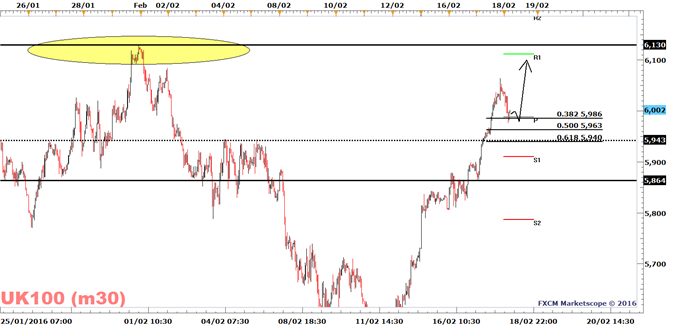

The FTSE 100 is down by 0.5% at the time of writing.

The pullback is probably due to profit taking on the heels of the 10% gain from last Thursday’s low of 5493, with the FTSE trading near the monthly high at 6129. And the price is trading slightly higher in comparison to the latest developments in the Bloomberg Commodity Index and DAX 30, which suggests it should be trading at 5976 and 5900 respectively.

Collectively these factors bring out long-term bearish traders, who like the risk/reward ratio for bearish positions at current levels. These traders expect the FTSE 100 to remain capped by the 6129 high and expect price to reach last week’s low of 5498. This provides a risk/reward ratio of 3.5 times the risk.

While this is an interesting setup and something which may play out over the next few days, for now the short-term trend is bullish and I see it as prudent to stick to the bullish bias or stay out, until a reversal takes place.

Short-Term Trend Is Bullish Above 5864

Yesterday’s low of 5864 is the latest swing low of the short-term uptrend and trend-followers will probably see a decline to the 5940 – 5986 range as an opportunity to add to their bullish exposure. As long as 5864 holds as support price may reach the monthly high at 6130.

Short-Term Trend Is Bullish Above 5864

Yesterday’s low of 5864 is the latest swing low of the short-term uptrend and trend-followers will probably see a decline to the 5940 – 5986 range as an opportunity to add to their bullish exposure. As long as 5864 holds as support price may reach the monthly high at 6130.

FTSE 100 | FXCM: UK100

Leave A Comment