“The paradox is one of the most completely established empirical facts in the whole field of quantitative economics.” – John Maynard Keynes

“The Gibson paradox remains an empirical phenomenon without a theoretical explanation” -Friedman and Schwartz

“No problem in economics has been more hotly debated.” – Irving Fisher

Introduction

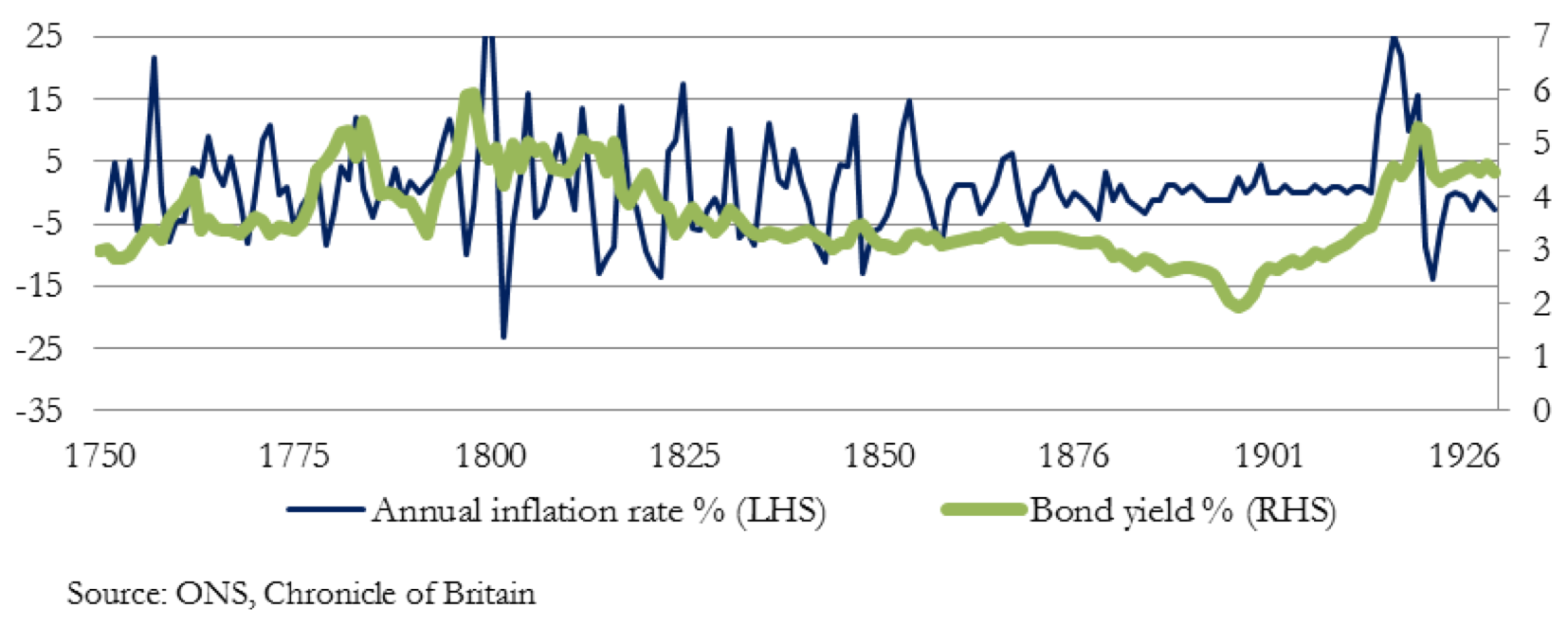

Two years ago, I found a satisfactory solution to Gibson’s paradox.i The paradox is important, because it demonstrated that between 1750-1930, interest rates in Britain correlated with the general price level, and had no correlation with the rate of price inflation. And as Friedman and Schwartz wrote, a theoretical explanation eluded even eminent economists, so economists preferred to assume the quantity theory of money was the correct guide to the relationship between interest rates and prices. Therefore, the consequence of resolving the paradox is that the supposed linkage between interest rates, the quantity of money and the effect on prices is disproved.

Gibson’s paradox tells us that the basis of monetary policy is fundamentally flawed. The reason this error has been ignored is that no neo-classical economist has been able to establish why Gibson’s paradox is valid, as the introductory quotes tell us. Consequently, this little-know but very important subject is hardly ever discussed nowadays, and it’s a fair bet most of today’s central bankers are unaware of it.

The relationship between interest rates and the general level of prices held until the 1970s. This article summarises why Gibson’s paradox functioned, why interest rates do not correlate with price inflation, and the reasons it failed to be evident after the 1970s.

For ease of reference, here are the two charts reproduced from my original paper that the paradox refers to, the first illustrating the correlation between interest rates and the price level, and the second the lack of correlation between interest rates and the inflation rate in Britain, the only country where such a long run of statistics is available.

Resolving the paradox boiled down to answering a very simple question: is the interest rate set by demand from the borrower based on what he is prepared to pay, or is it set by the interest rate demands of the saver, seeking a decent return on his money? The neo-classical assumption has it that in a free market it is what the saver demands to part with the temporary use of his money that controls the loan rate, and the borrower is at his mercy.

Indeed, all the literature going back to pre-Keynesian days assumes that consumers decide interest rates by dividing consumption between what is needed today, and what should be saved for the future. The problem that preoccupied theologians was that of greedy savers, morally guilty of usury. The two principal monotheistic religions, Christianity and Islam, held that usury is a sin, and Islam to this day insists its followers must not lend for interest. The vision of the idle rich living off the income of their capital also fuelled post-Marxian sentiment. The bias of opinion has always been against the seemingly idle saver and in favour of the industrious debtor. The saver is cast as a villain, and even central bank policy today is biased against him.

The assumption, that it is the saver who demands the interest rate, carried throughout the known history of economics, and finds its more recent expression with Keynes, who wanted to do away with saving altogether.ii He gave savers the epithet of rentier, an ugly word suggesting a rich man who rents out his capital, gathering in profit from the efforts of others. I found only one exception to this common view in the textbooks, and that was almost an aside in von Mises’s Theory of Money and Credit. He stated that the demand for capital takes the form of a demand for money.iii

So, money is demanded. Mises’s view of the relationship of cash to loans, which Keynes in his General Theory professed to not understandiv, overturns religious and socialist assumptions about the wicked saver. According to von Mises, he provides a service to businessmen by making capital available for production. Going back a page in von Mises’s Theory, we find that he also held that:

Capital goods or production goods derive their value from the value of their prospective products, but as a rule remain somewhat below it. The margin by which the value of capital goods falls short of that of their expected products constitutes interest; its origin lies in the natural difference between present goods and future goods.v

This being the case, clearly the rate of interest is set by what the borrower will pay to secure profitable production of future goods, not what a usurious rentier, as Keynes and others had it, will demand.

The businessman sets the price of borrowing by having the option not to borrow. In his calculations, he will attempt to quantify his fixed and marginal costs of production, and the added productive capacity additional capital will provide. He must estimate the wholesale value of his extra production, to assess his profits, gross of interest. He is then able to judge what interest he is prepared to pay to secure the capital required for a viable proposition. The businessman’s expectation of wholesale values is therefore linked to the cost of borrowing. It is for this reason that the interest paid by a manufacturer and wholesale values correlated, and therefore why interest rates correlated with the general price level.

Leave A Comment