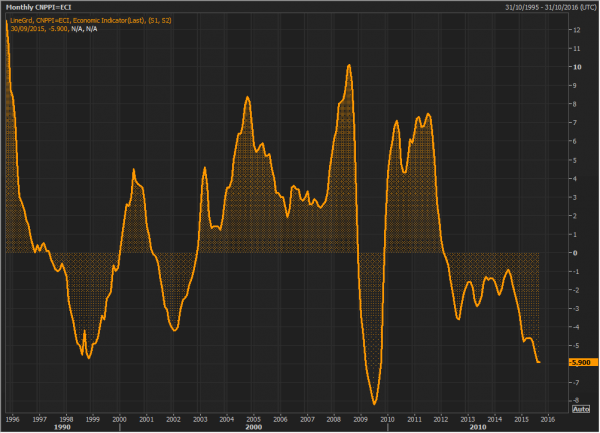

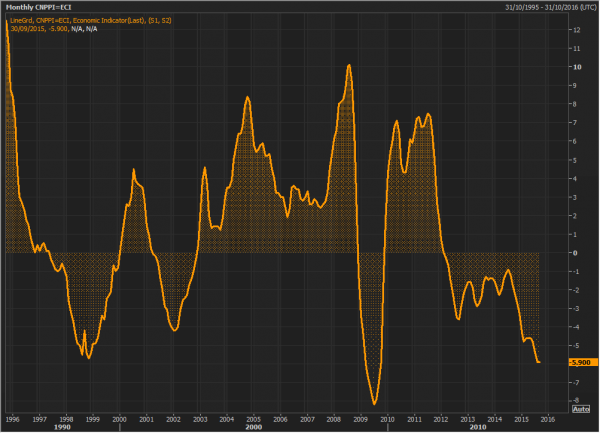

When China was closed for one week at the end of September, something which helped catalyze the biggest weekly surge in US stocks in years, out of sight meant out of mind, and many (mostly algos) were hoping that China’s problems would miraculously just go away. Alas after yesterday’s latest trade data disappointment, it was once again China which confirmed that nothing is getting better with its economy in fact quite the contrary, and one quick look at the chart of wholesale, or factory-gate deflation, below shows that China is rapidly collapsing to a level last seen in 2009 because Chinese PPI plunged by 5.9% Y/Y, its 43rd consecutive drop – a swoon which is almost as bad as Caterpillar retail sales data.

Consumer price inflation wasn’t much better (aside from food prices which jumped, but as the Fed has repeatedly acknowledged, nobody cares about rising food prices), and at 1.6%, it came below the 1.8% expected, resulting in the first slowdown in 4 months.

The result of this latest Chinese economic rout dragged Asian equity markets traded lower as risk sentiment remained weak following yesterday’s release of soft Chinese import figures. Nikkei 225 (-1.9%) underperformed and fell below 18,000 amid broad based losses, while the ASX 200 (-0.1 %) was weighed on by the energy sector as crude prices remained near lows. Shanghai Comp. (-0.9%) pared its lacklustre CPI and PPI inspired losses following gains in material names, after the announcement of domestic output cuts and gains in metal prices. Finally, JGBs trade mildly higher amid weaker risk sentiment in Asia.

Perhaps the biggest consequences of China’s inflation data is that the world’s second largest economy continues to export deflation at an alarming pace, as was confirmed just an hour ago when Germany sold 5 Year Bunds at a negative rate of -0.03%, down from +0.12% in September, and the lowest since April as negative rates once again return to Germany and are sure to make the ECB and Buba’s life a living hell.

The European equity session kicked off with yet another uninspiring performance by equity indices (Euro Stoxx: -0.8%), with stocks heading into the North American session lower across the board as market participants digest more disappointing macroeconomic data from China and also react to less than impressive earnings report by JP Morgan. Also of note, ASML shares (-4.1) fell sharply in early European trade after Europe’s largest semiconductor-equipment maker warned of lower demand.

As a result, flight to quality trade supported Bunds since the open, with peripheral bond yield spreads widening and Portuguese bonds underperforming ahead of supply. Looking elsewhere, further flattening has been seen on the short-sterling curve amid a somewhat mixed UK jobs report (ILO Unemployment Rate 3Mths M/M 5.40% vs. Exp. 5.50%, Weekly Earnings ex-Bonus 3M/3M Y/Y 2.80% vs. Exp. 3.00%).

In FX, Cable has been the notable outperformer in FX markets, with participants focusing on the employment aspect of the UK data rather than the wage growth, which revealed the highest employment rate since records began in 1971, with GBP also benefiting from M&A flow on the back of yesterday’s SABMiller and AB InBev provisional agreement.

Elsewhere, the USD-index has continued to ebb lower during European hours as EUR was supported by an unwind of carry trades amid the risk-averse tone, USD is also being weighed on by GBP which is paring some of yesterday’s losses with GBP/USD breaking out of its tight overnight range. This meant that the preferred risk carry trade, the USDJPY is now below 119.50 and sliding.

And most curiously, until just minutes ago China’s deflationary wave also meant that gold was soaring – since it implies even more easing by the PBOC eventually – and then out of nowhere, perhaps the BIS gold selling team finally came back from lunch, gold had a furious slam which sent it lower by $10 in the matter of seconds, a move reminiscent of the now busted spoofs that we caught in the past and which led the CFTC to actually do something for once.

Leave A Comment