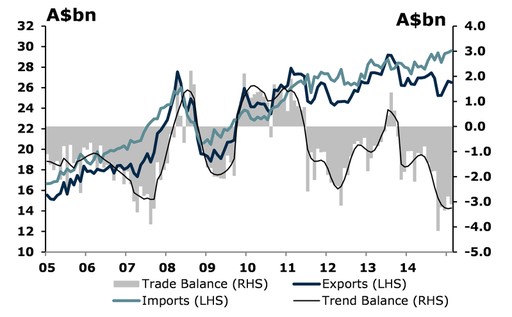

The best headline to summarize what happened in the early part of the overnight session was the following from Bloomberg: “Asian stocks extend global rally on stimulus bets.” And following the abysmal data releases from the past three days confirming that the latest centrally-planned attempt to kickstart the global economy has failed, overnight we got even more bad data, first in the form of Australia’s trade deficit, which at A$3.1 billion, came in well wider than the S$2.8 billion expected, and up from the revised A$2.8 billion in July, the largest deficit since June as experts remained flat while imports rose by 1%.

Then moving from Asia to Europe, we got more validation for the “stimulus bets” when Germany’s factory orders which once again confirmed the recent PMI weakness, and bombed at an abysmal -1.8%, far below the 0.5% expected, while the Y/Y print was a feeble 1.9% on expectations of a 5.6% increase, with the last month revised to -1.3%, driven by a collapse in orders from outside the Euro area (coughchinacough).

This is what Goldman had to say on the terrible data: German manufacturing orders fell by 1.8%mom in August. Domestic orders decreased 2.6%mom and foreign orders 1.2%mom. Orders from the Euro area were up 2.5% on the previous month, while orders from outside the Euro area decreased 3.7%mom. Within the breakdown for type of goods, manufacturers of intermediate goods recorded decreases in new orders of 0.4% and the manufacturers of capital goods of 2.8% on the previous month. New orders of consumer goods fell by 1.5%.”

Goldman’s punchline: “the weakness in orders from outside the Euro area seems to reflect genuine weakness in China and emerging markets in general and this will weigh on the German manufacturing sector.”

The recent Volkswagen scandal will hardly boost Germany’s suddenly struggling manufacturing powerhouse.

So after all this bad data, the “bad news is good news” rally should have really gone into overdrive, right? It did in Asia: Asian equity markets traded with firm gains for a consecutive day on the back of expectations for a fed lift-off being pushed back. Nikkei 225 (+0.8%) outperformed in the region led by broad based gains as the TPP deal was clinched, while the ASX 200 (+0.3%) was led higher by gains in commodities. Hang Seng (-0.1%) pared earlier advances as Nikkei Hong Kong PMI (45.7 vs. Prey. 44.4) printed a 7th consecutive month of contraction. Participants from mainland China were away due to Golden Week holiday. JGBs traded lower amid strength in equity markets, while the weaker than prior enhanced liquidity auction initially added to losses, but then some were later pared.

And while Asia was soundly stronger, stocks in Europe swung between gains and losses (Euro Stoxx: +0.4%) as market participants used the recent upside to book profits while the pushed back expectations of rate hike by the Fed offset the resultant selling pressure. On a company specifc basis, Glencore (-2.7%) underperforms to pare back some of yesterday’s gains. In terms of US equities, PepsiCo (PEP) reported Q3 EPS of $1.35 on Exp. of $1.26, with YUM Brands reporting after the closing bell.

At the same time, despite the mixed performance by equities, Bunds edged lower since the open, paring the entire opening gains . Gilts have underperformed, albeit marginally, on touted positioning linked to the 2034 tap by the DMO.

Of note, analysts at Citi forecast global equities rising 20% by Dec 2016, suggesting the global bull market is not over. At the same time, ‘unloved’ energy sector upgraded to neutral and industrials downgraded to underweight.

In commodities, energy products mimicked the price action that of European equities this morning, with prices gradually recovering following the initial move lower to trade little changed while metals markets have seen gold traded sideways overnight with prices remaining near its best levels in a week. Elsewhere copper prices were mildly lower amid subdued demand with the world’s biggest consumer not returning to the markets until Thursday and prices of lead continued their decline to fall to its lowest level since June 2010.

Leave A Comment