After yesterday’s US and UK market holidays which resulted in a session of unchanged global stocks, US futures are largely where they left off Friday, up fractionally, and just under 2,100. Bonds fell as the Federal Reserve moves closer to raising interest rates amid signs inflation is picking up. Oil headed for its longest run of monthly gains in five years, while stocks declined in Europe.

Treasuries retreated in the first full day of trading since Yellen said late Friday that the improving economy meant a rate increase would probably be in order “in the coming months.” European shares dropped for the first time in six days as Volkswagen AG led carmakers lower after reporting a slide in profit at its namesake brand. In China, stocks climbed even after a flash crash in index futures with the Shanghai gauge jumping the most in almost three months. Gold rose for the first time in 10 days.

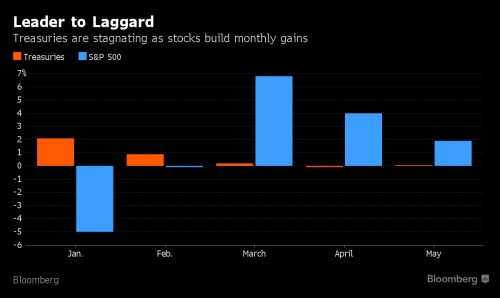

The recent monthly outperformance of TSYs over stocks is shown below.

Boosting expectations that the Fed may hike over the next few months is confirmation that the data are beating analysts’ forecasts by the most in about 16 months, according to the Bloomberg ECO U.S. Surprise Index.

The Fed’s rate outlook is occupying investors as futures show odds of a hike in July at more than 50 percent while gains in commodity prices from crude to crops bolster prospects for inflation. With officials emphasizing policy tightening is dependent on economic improvement, investors will be scrutinizing payrolls and personal income data due this week.

“The payroll data is probably the key figure that will shape the Fed decision,” said Otto Waser, chief investment officer of R&A Group Research & Asset Management in Zurich. “If the payroll data is weaker than what is now expected, it will raise the chance they won’t hike.” This is an all too real probability, because as we reported yesterday, as a result of the Verizon strike which even the BLS has noticed, the consensus print of +160,000 may be trimmed by as much as 35,000 jobs.

The potential for higher U.S. yields helped send a gauge of the dollar versus major peers to its biggest monthly gain since September 2014. “Yellen’s speech Friday afternoon was the key focus and people had the long weekend to ponder,” said Veronika Pechlaner, who helps oversee $10 billion at Ashburton Investments, part of FirstRand Group. “It would be a positive sign if we could stabilize and keep these levels, but we’ll see whether people take money off the table ahead of rate action. The market sold off after the last rate hike and we’re not in a much stronger position this time. That said, 25 basis points shouldn’t really do much.”

U.S. stock-index futures were little changed before data that may indicate how ready the economy is for higher interest rates that could come as soon as next month. Celator Pharmaceuticals Inc. soared 73 percent in early New York trading after agreeing to a $1.5 billion takeover offer from Jazz Pharmaceuticals Plc. Frontline Ltd. jumped 1.7 percent after the oil-tanker company posted better-than-estimated first-quarter net income.

Contracts on the S&P 500 expiring in June rose less than 0.1 percent to 2,098.25 at 6:04 a.m. in New York. The benchmark equity index advanced Friday, capping its best week since March. Dow Jones Industrial Average futures added 26 points, or 0.2 percent, to 17,875 today. U.S. markets were closed on Monday for the Memorial Day holiday.

Market Wrap

Top Global News

Looking at regional markets, Asia stocks recovered from early losses to trade mostly higher with optimism in Chinese markets bolstering sentiment. Nikkei 225 (+1.0%) shrugged off discouraging Industrial Production data as JPY weakness underpinned exporters, while ASX 200 (-0.5%) underperformed following weakness in energy and retail names. China spearheaded the region’s ascent with both the Hang Seng (+0.9%) and Shanghai Comp (+3.3% )ignored a 12% flash crash in CSI-300 futures, edging firm on gains with financials underpinned after the PBoC upped its liquidity injection and reports Bank of China is to realise a HKD 30Bn profit from sale of one of its units, while prospects of MSCI inclusion further adding to the upbeat tone. 10yr JGBs traded flat despite the risk-on sentiment in the region and a than 2 year JGB auction with a better than prior b/c.

Leave A Comment