After two consecutive days of miserable Chinese econ data, when first imports and exports, and then wholesale deflation disappointed for one more month, overnight we got even more Chinese data this time on the “credit input end” when Beijing reported its September money creation statistics.

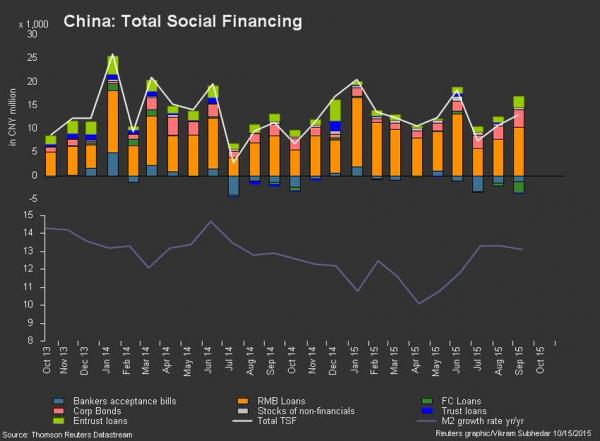

Overall M2 rose at 13.1%, in line with consensus, and the highest since June, but where things improved notably (if one considers an overindebted China rushing to add even more debt an improvement) was in total CNY loans which rose from CNY810BN to CNY1.05TN or CNY150 billion above consensus, as well as a jump in total social financing which printed at CNY1.3 trillion vs CNY1.3 trillion consensus, up over CNY200BN in the month, and the highest print since June.

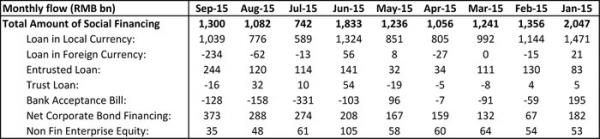

Monetary data summary

Total social financing breakdown

As Goldman summarizes:

“September monetary conditions remained ample. Ample monetary conditions are helpful in supporting the economy which has been weak after the middle of the year. We do not think the recent change in collateral requirements for small enterprises and agricultural related relending will have a big additional impact on monetary conditions. But the central bank still needs to cut RRR amid continued (but reduced) outflows and the recent increase in repo rates, and also lower interest rates amid lower CPI inflation to just keep monetary conditions stable.“

Aside from Chinese monetary data, it was a relatively quiet session in which traders were focusing on every move in the suddenly tumbling USD, and parsing every phrase by central bankers around the globe, as well as the previously noted piece by Fed mouthpiece Jon Hilsenrath which effectively ended the debate whether there will be rate hikes in 2015.

Adding to the overnight froth, were ECB speakers – first Ewald Nowotny and then Spain’s Restoy – who said that euro-area core inflation “clearly” below goal, remarks which were immediately assumed to signal increasing pressure to boost stimulus, and which promptly translated into even more weakness in EUR and strength in Bunds throughout the European morning. Ironically this is just a flipflop from late September, when Draghi implicitly stated no to expect more QE from the ECB so the focus turned to Japan. However, with the USDJPY tumbling, the signal is clearly that Kuroda will now wait, and all eyes turn back to Mario Draghi.

This back and forth will continue until neither one hikes, or until the market loses patience and something snaps badly forcing the central banks – which are desperate to jawbone as long as possible because they all know any incremental act will merely accelerate the endgame in which they have no choice but to paradrop money – to act.

In any case, with the dollar tumbling early in the overnight session, and with the ECB only adding fuel to the “more QE” fire, futures have soared and more than wiped out most of yesterday’s losses, despite Walmart which this morning continues to slide and was down another 1% at last check below $60, on pace to boost the dividend yield to 4%.

Looking at stocks, starting in Asia we saw equity markets shrugged off the lacklustre close on Wall Street to trade higher, as poor US retail sales pushed back Fed rate hike expectations . Nikkei 225 (+1.2%) recovered back above 18,000 after USD/JPY rebounded off its lows, while the ASX 200 (+0.6%) was underpinned by mining names after gold prices climbed to 3%-month highs. Hang Seng (+2.0%) and Shanghai Comp. (+2.3%) resided in positive territory amid gains in telecoms, following the announcement that 3 top telecom firms will combine some assets into a new entity. JGBs traded relatively flat despite the strong risk on sentiment in markets, while the BoJ also entered the market to purchase JPY 1.18trl of government bonds.

Stocks in Europe traded higher since the open (Euro Stoxx: +1.4%), as the release of lower than expected US retail sales yesterday , together with less than impressive start to the latest US earnings season, continued to dampen rate hike expectations by the Fed. This together with dovish comments by ECB’s Nowotny who said that additional set of instruments are necessary, meant that despite the supply from Spain and France, Bunds traded in the green this morning.

Leave A Comment