The U.S. Federal Reserve meeting on Wednesday is likely to overshadow all other economic events over the week. After nearly a month of the markets rallying in anticipation of a Fed rate hike, the markets are geared up for a second rate hike in almost a year after the initial 25 basis points increase. Across the Atlantic, the Bank of England’s meeting is likely to be a non-event in comparison, but the week still holds some important reports from the UK. Here’s the weekly guide to the forex markets this week.

U.S: FOMC meeting, retail sales, and inflation

The Federal Reserve’s meeting on Wednesday will see the central bank hike interest rates by 25 basis points, which will push the Fed funds target rate to 0.75%. With the rate hike priced in by the markets, the focus will turn to the forward guidance as the Fed will also be releasing the staff economic projections. The markets will be curious to know the pace of rate hikes over the next year which could be a key indicator for further strength in the U.S. dollar.

However, the strong rally since the November 8th election also highlights the risk of a downside reaction on the dollar which stands firmly above the 100.00 psychological level.

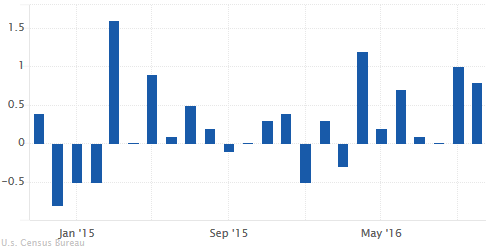

Besides the Fed’s meeting, economic reports from the U.S. this week will include the retail sales figures due out on Wednesday before the FOMC meeting as well as the producer price index data. Retail sales excluding autos are tipped to moderate, rising only 0.4% on a month over month basis in November. This comes after a 0.8% increase in October (which followed a 1.0% increase in September) while the retail sales control group is expected to rise 0.4%, down from 0.8% previously.

US Retail sales 0.8%, October 2016

U.S. producer prices which remained flat on the headline in October is expected to rise a modest 0.1% while core PPI excluding food and energy is expected to rise 1.3% on a year over year basis.

UK: Bank of England expected to hold rates steady

Leave A Comment