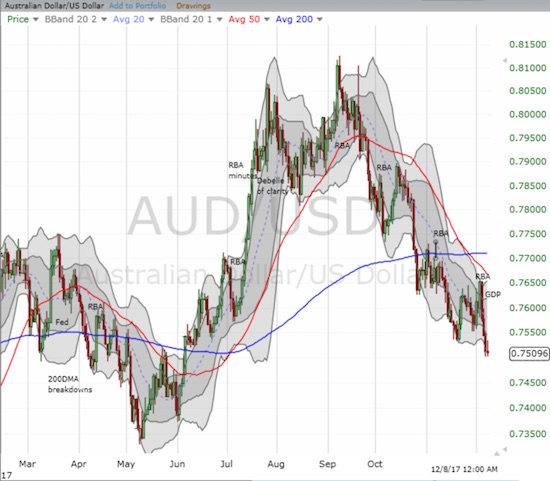

The currency market painted a bullish interpretation of the latest monetary policy decision from the Reserve Bank of Australia (RBA). By the time of the September quarter GDP report, that incremental bullishness disappeared and setup a bearish interpretation of the Australian economy.

Source: FreeStockCharts.com

The Australian dollar swung wildly intraday from a post-RBA celebration to a fade and disappointment over the GDP report. AUD/USD suffered a complete reversal ahead of the GDP report.

The net result, which includes a U.S. jobs report, is an Australian dollar whose breakdown and 3-month long tumble from the top received a fresh confirmation of bearishness. AUD/USD is at its lowest point in 6 months.

Source: FreeStockCharts.com

The Australian dollar continued an extended slide against the U.S. dollar. AUD/USD is at a fresh 6-month low.

The RBA statement did not seem to offer anything startling. The RBA left its interest rate unchanged and said nothing about the prospects for rates. According to the RBA, the economy looks pretty good:

“Business conditions are positive and capacity utilisation has increased. The outlook for non-mining business investment has improved further, with the forward-looking indicators being more positive than they have been for some time. Increased public infrastructure investment is also supporting the economy…Employment has been rising in all states and has been accompanied by a rise in labour force participation. The various forward-looking indicators continue to point to solid growth in employment over the period ahead.”

The caveats included in the statement were relatively minor. Commentary about the shortage of skilled labor for some employers and the tightening of lending standards perhaps subtly added to an overtone of hawkishness that the currency market over-interpreted.

GDP for the September quarter came in at 2.8%, slightly below the RBA’s central forecast of a 3.0% average for the next few years. The quarterly growth of 0.6% was below the previous quarter’s 0.9% gain. Together, perhaps these numbers disappointed the market. Yet, the report itself spoke of strength – granted some of these measures are coming off major multi-year lows:

Leave A Comment