Moments ago, after having called the bear market bounce for what it was just on February 11, and positioned accordingly to take advantage of the expected 6-8% rebound…

… Swiss private bank Geneva Swiss Bank just called the end of the bear market rally, and has gone back to a market neutral stance.

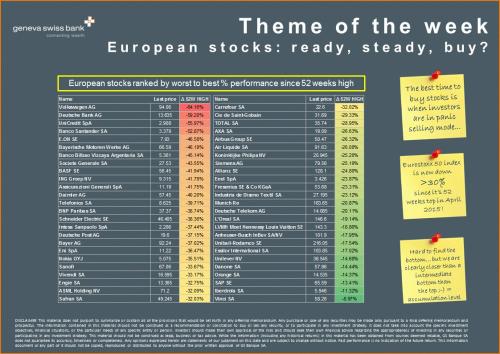

Here is its reasoning:

Dear All,

Please note that after this nice rebound in equities, we are moving tactically cautious.

Actions taken today: we moved to market neutral (long equities / short index futures) on our new Swiss Tactical Equity Certificate and have bought downside protection on the S&P500 in our portfolios.

We believe that :

- This was just a bear market rally driven essentially by hedge funds covering their shorts…

- Many risks including China/CNY, Oil supply, US economy, German economy/social situation, BREXIT, earnings growth, high valuations, still remain in mind.

- Investors are losing confidence in Central Banks hazardous monetary policies and buying gold as the ultimate hedge… You might want to read this article on gold I wrote for Citywire last July >>> link

And by the way…

- Negative: Major equity indices have technical opening-gaps to be closed (15.02.2016) >>> 1860 for the S&P500 and 2756 for the Eurostoxx50

- Positive: something interesting might come out of next G20 meeting in Shanghai. Finance ministers and central bank governors are due to meet on Feb. 26 and 27 to discuss issues including China’s excess capacity, oil prices and global growth….

It appears that to GSBank’s CIO, Loïc Schmid, the negatives to outweight the positives at this moment.

Furthermore as we noted earlier, while stocks have soared relentless into today’s latest short squeeze, not only bonds…

… but the all important USDJPY carry trade…

… have both completely ignored today’s move in equities.

Leave A Comment