A couple of weeks ago in “‘This Was Inevitable At Some Point“, we asked a simple question: is there a storm coming for emerging markets?

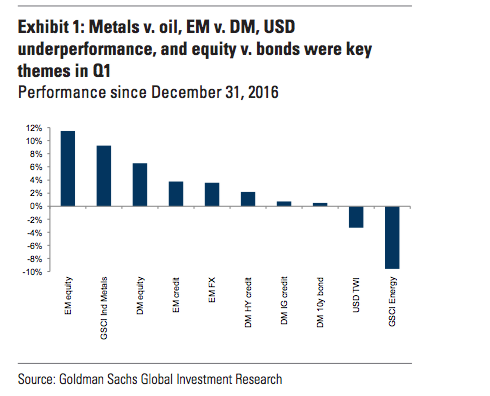

The point was pretty simple really. EM has held up remarkably well in the face of what is supposed to be a Fed tightening cycle. Indeed, Q1 worked out quite well if you were long anything with the prefix “EM.”

(Goldman)

In a testament to just how “cray” EM’s resiliency truly is, we also noted (a short while after the post linked above was published) that on a Fed Minutes day, the Vanguard FTSE EM ETF got its biggest daily inflows since 2012 ($872.5M):

(BBG)

Here’s how we attempted to explain the apparent anomaly:

Attribute this resiliency as you see fit. That is, maybe it was the fact that the dollar had a terrible Q1. Or maybe it was partially due to the fact that the March Fed “hike” was actually a “cut” if you care to consult financial conditions. Or maybe no one is buying what the Fed is selling in terms of their intentions. Or maybe today’s portfolio managers are too young to remember what a tightening cycle actually is.

Well on Wednesday, Goldman is out asking an important follow-up question. Namely, “if the VIX sneezes, will EM catch a cold?” Excerpts from the note are below.

Via Goldman

Leave A Comment