Written by Sean Brodrick

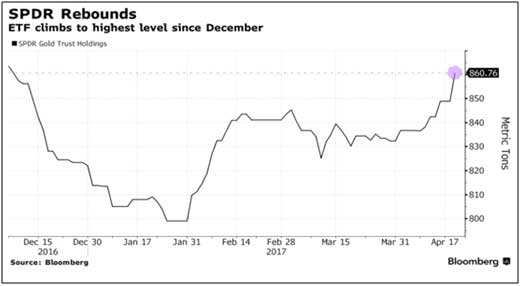

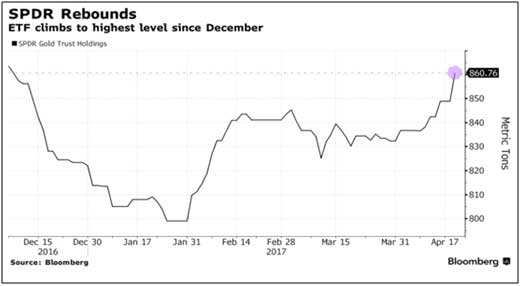

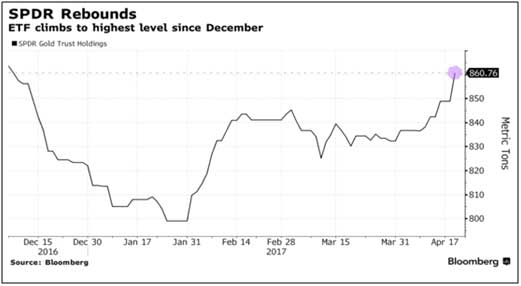

Do you want to see a picture of fear? Just look at what’s happening in the world’s largest gold ETF in the chart below. The SPDR Gold Trust (NYSE: GLD) added 11.84 metric tons of gold on April 19. That’s the most since Sept. 6, 2016, and it brought the GLD’s holding to 860.76 metric tons. That’s 27,674,076 troy ounces. What’s driving this? Fear.

What’s driving this? Fear.

North Korea is turning up the heat on its nuclear threat. In fact, North Korean state media just warned the United States of a “super-mighty preemptive strike.” What does that mean? Who the heck knows! We do know that the U.S. is now calling North Korea an “imminent threat” -and you can bet people are hedging nuclear fears with gold.

Meanwhile, the Trump administration may walk away from the nuclear deal with Iran. Secretary of State Rex Tillerson said Wednesday that Iran if left “unchecked,” could follow North Korea’s path to becoming a nuclear rogue nation. “The evidence is clear. Iran’s provocative actions threaten the U.S., the region, and the world.” Tillerson said. Another nuclear threat? Maybe. And maybe time for more gold.

Then take the French election…The two leading contenders are, on the right, someone who wants to take France out of the euro and NATO and, on the left, a good ol’ fashioned left-wing socialist. That’s gonna make investors nervous either way.

These are the known problems, but you can bet your bottom krugerrand that the market is starting to worry about black swans, too. The events you can’t predict.

You know who else is buying gold? Russia. Slowly, steadily, the Russians add to their Smaug-worthy hoard o’ gold every month. Russia’s gold holdings just hit 54 million troy ounces. That’s up 800,000 troy ounces in one month but it’s the tip of an iceberg that has been rising for years.

Leave A Comment