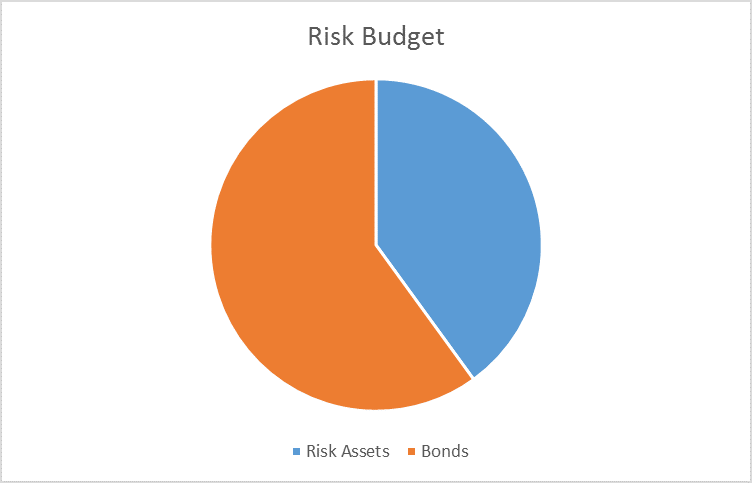

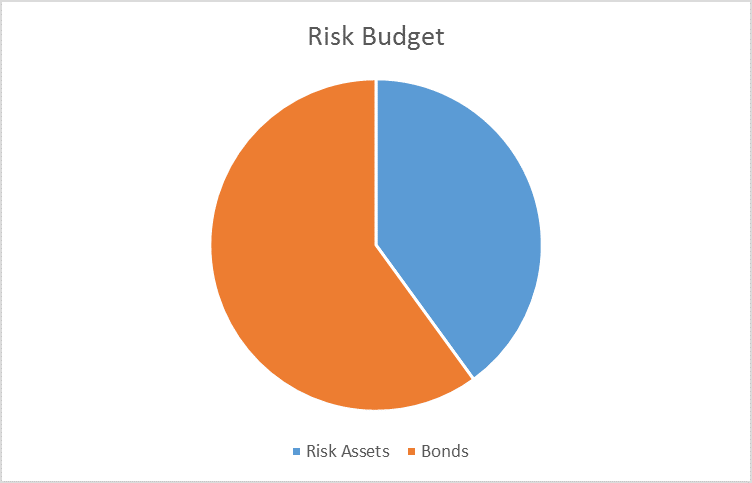

The risk budgets are again unchanged for this month. For the moderate risk investor, the allocation between risk assets and bonds remains at 40/60. The changes in our indicators this month were not significant enough to warrant a change. Credit spreads stopped narrowing and have recently been widening again, ever so slightly. Valuations, long term momentum and the yield curve have not changes materially since the last update.

As I noted in the Bi-Weekly Economic Review last week, the economic data has improved somewhat from a surprise perspective but the overall tone of the reports – other than the regional Fed surveys – has been fairly negative. Nevertheless, the firming tone of the reports served to at least stop the dollar from declining further – for now. That dollar stability worked to put a short term cap on oil prices and that had an impact on credit spreads. Spreads had narrowed, as noted in the last GAA update, as oil prices moved higher on hopes, apparently, that the shale industry might avoid the worst case scenario. Now that oil has started to correct, so too have spreads started to widen again. It isn’t a big move but it keeps the previous widening trend intact. Stocks have not yet reacted to the resumption of spread widening although the rate of ascent has slowed. Nominal bond prices resumed their uptrend though despite the good mood in stocks.

Indicator Quick Review

Credit Spreads

Credit spreads continued to narrow after my last update but have since resumed the previous widening trend. The trend in fact was never broken despite the considerable narrowing of spreads. So, now we wait to see if spreads widen further and what impact that will have on the stock market. I suspect wider spreads will be dependent on further weakness in crude oil prices which is probably dependent, at least to some degree, on a stronger dollar. Oil is still in a downtrend despite its recent rally so it may not take much dollar strength to push it lower.

Leave A Comment