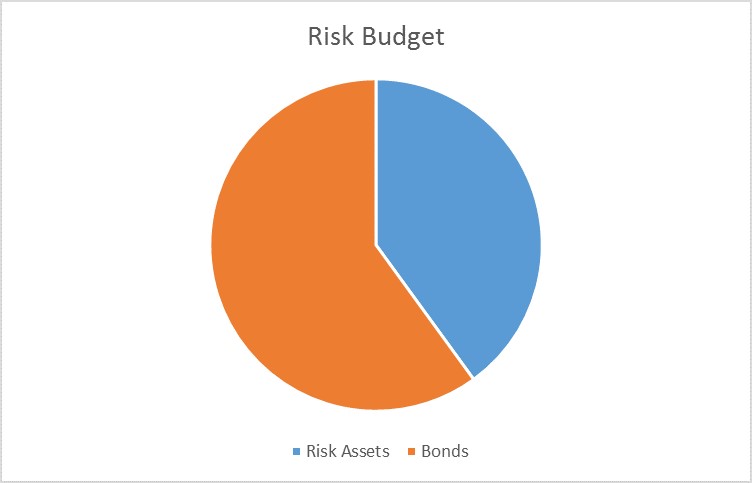

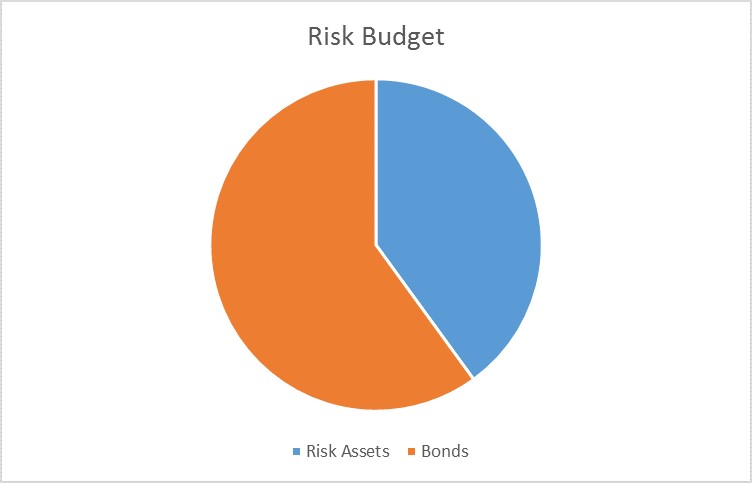

The risk budgets this month are unchanged. For the moderate risk investor, the allocation between risk assets and bonds remains at 40/60 versus the benchmark of 60/40. While the BofA ML High Yield Master II OAS did widen significantly since the last update I’ve decided not to reduce the risk allocation more at this time. The stock market selloff and bond market rally has already changed our allocation somewhat and I would not rebalance at this time.

A further reduction in equity exposure at this point is tantamount to predicting a recession and while there is plenty of reason for concern, I don’t think we can make that call just yet. The odds have risen but they aren’t 100%. With more at stake on the bond side, at this point our bigger risk is that we don’t have a recession and adding to bonds at this point could actually be increasing risk. I am making some changes to the bond side for exactly that reason, reducing duration after the big rally on the long end. If we get some kind of countertrend rally in stocks and we have reason to believe recession is more likely, we may yet move the risk allocation lower. But for now, I think our current allocation is adequate protection.

Leave A Comment