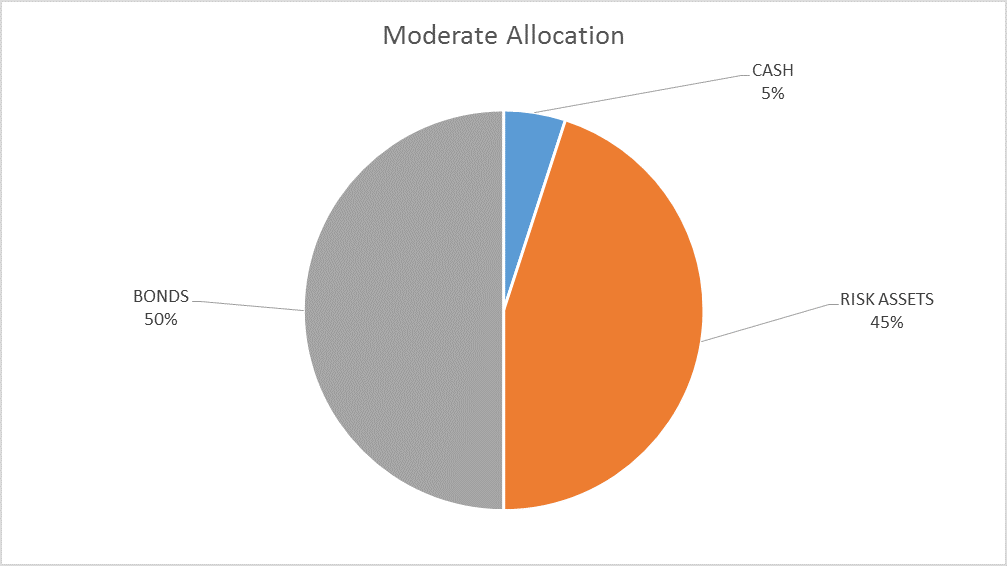

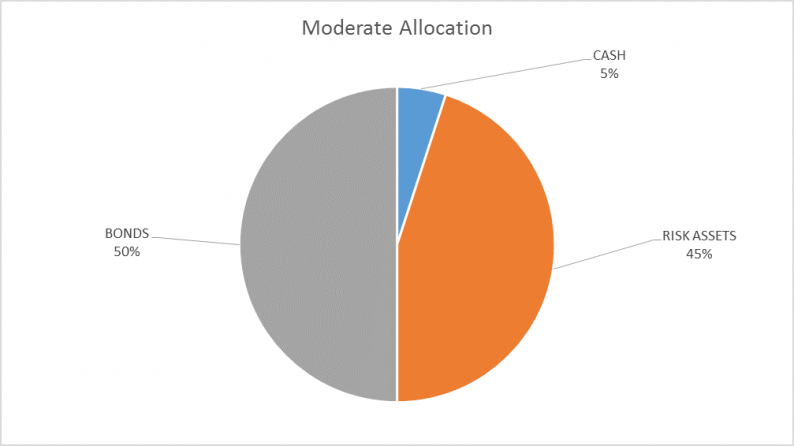

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market persists so I will continue to hold a modest amount of cash. There are some minor changes within the portfolios but the overall allocation is unchanged.

There have been two major developments since our last asset allocation update. First, the Fed raised rates at its December meeting and the Fed funds rate target is now 1.25 – 1.5%. Second, Republicans finally managed to pass the tax reform package, cutting both corporate and personal income taxes. The effect of both events on markets was…not much. Of course, both events were well anticipated so it may be that the impact was already factored into market prices but considering the market action before the two events, one wonders if the real reason markets didn’t move is that neither action really accomplishes all that much.

The Fed rate hike was, as all Fed actions are these days, well telegraphed. I do not agree with the Fed’s communication policies, least of all the modern method of preparing markets in advance for policy changes. Call me old fashioned but I think we were better off when we had to watch the Dow Jones newswire after an FOMC meeting to see if the open market desk entered the market, signaling a change in policy. The idea that central banks shouldn’t surprise markets is based on a false premise, namely that market volatility should be avoided. It is ironic indeed that Janet Yellen once said Hyman Minsky’s writings should be required reading and she now oversees a policy regime almost perfectly suited to creating a Minsky moment. Tamping down volatility for this extended period of time gives speculators the confidence to engage in, well, speculation.

And there is no doubt that speculation is rampant in the global economy. Everyone knows about the recent purchase of an alleged Da Vinci painting for nearly a cool half billion dollars. But that is merely the latest example from the art world. The previous record for a painting sold at auction was in 2015 for one of the 15 versions of Picasso’s “Les Femmes d’Alger”, the gavel falling at $180 million. Let’s see 15 times 180…. Frankly, I was more shocked by the sale of a Twombly for $46 million at the same auction that produced the Da Vinci sale. Seriously? At a youthful 12 years old the paint is barely dry on Cy’s squiggles.

Bitcoin is a product of the same speculative tilt to the global economy, a token that entitles you to exactly nothing of value. Yeah, yeah, I’ve heard about therevolutionary (how does one sneer in print?) blockchain technology that underlies Bitcoin and other cryptocurrencies. In fact, I’ve spent numerous hours reading detailed research on the topic and have yet to find a problem for which it is the ideal solution. Indeed, I haven’t come up with anything for which it is a better solution than what currently exists. But the price moves and speculators can dance to it so I give it a 10 Mr. Clark. There are other examples of speculation such as some European junk bonds trading at yields so low that no company should ever have to suffer the indignity of bankruptcy but for pure entertainment value you can’t beat Jesus coin. From the ICO:

Decentralizing Jesus on the Blockchain: Jesus Coin is the only cryptocurrency of God’s favorite son. Together we’re working to speed up entry to heaven, decentralize the church and improve p2p (pilgrim to pilgrim) transaction time.

Leave A Comment