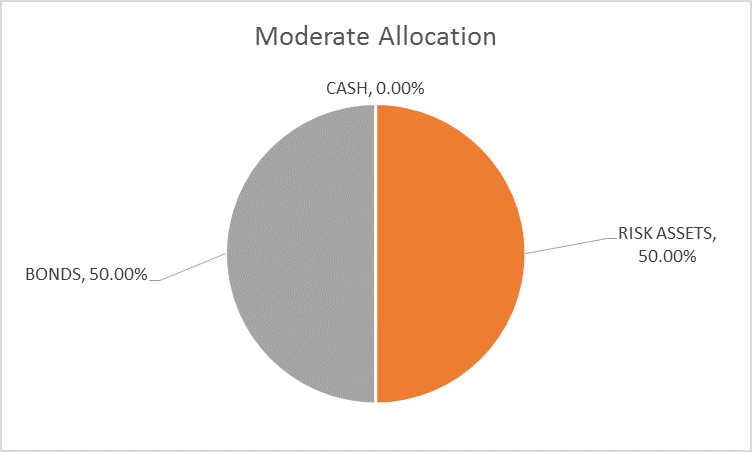

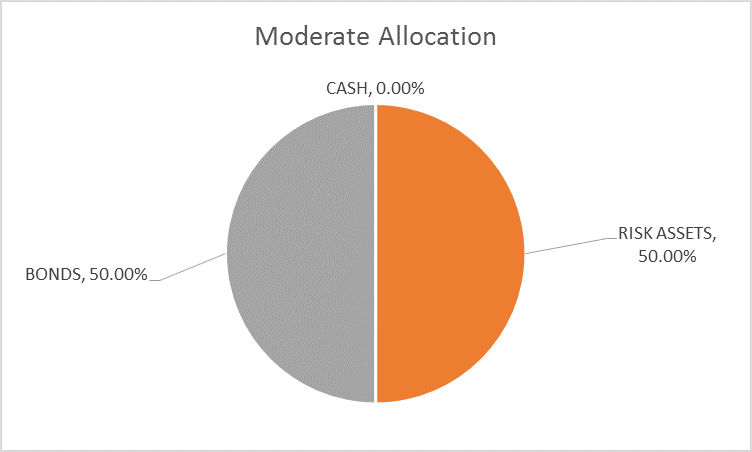

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50.

The performance of markets in the first quarter of the year was a bit schizophrenic. Stocks performed well which one might interpret as a reflection of improving economic growth prospects. Certainly President Trump and his proxies were quick to take credit but unfortunately for the new administration if they are responsible then they seem to be making foreign markets and gold miners great again sooner than America. Gold outperformed stocks by a pretty wide margin over the first three months of the year and foreign stocks outperformed their US counterparts. The gold move should be the more concerning as it isn’t generally a good sign for growth when investment is flowing into the barbarous (to some) relic.

Bond market performance in the quarter didn’t support the rising growth expectations scenario either and that has only gotten worse in the first couple of weeks of the new quarter. The 10 year note started the year at 2.45%, ended Q1 at 2.46% and was more recently trading at 2.25%. Rates were already falling after peaking in mid-December so i think it is safe to say that this is a trend at this point, although one that is a bit extended. How far it goes may have something to do with the administration’s ability to get tax reform or healthcare reform or some kind of reform through Congress this year. Or not. I think it is easy to credit or debit the President with economic performance but frankly the ability of any President to influence the direction of the economy is more limited than most seem to think – as President Trump is finding out first hand.

The S&P GSCI index was by far the worst performer of the asset classes we track for our Global Asset Allocation portfolios, down a tad over 5%. And again, not what one would expect if growth were expected to accelerate. Performance has improved in Q2, cutting the loss about in half, as oil prices rebounded but further gains will probably be harder to come by in the quarter. Technically, crude oil is approaching some stiff resistance, inventories are continuing to build and the rig count is rising pretty relentlessly. More generally, commodity prices have come off the lows they set in early 2016 and have mostly trended higher since. In fact, the long term technical picture looks pretty good right now and I wouldn’t be surprised to see the rally continue. But I suspect that will have more to do with the direction of the dollar than the economy.

Leave A Comment