After a brutal two-day selloff that wiped out trillions in market cap and saw the most aggressive selling pressure in the S&P since the flash crash on Thursday afternoon, prompting some to speculate that the bottom had been hit…

… global shares staged a broad recovery on Friday enjoying their best day in nearly a month as strong trade data from China propped up markets at the end of a tumultuous week.

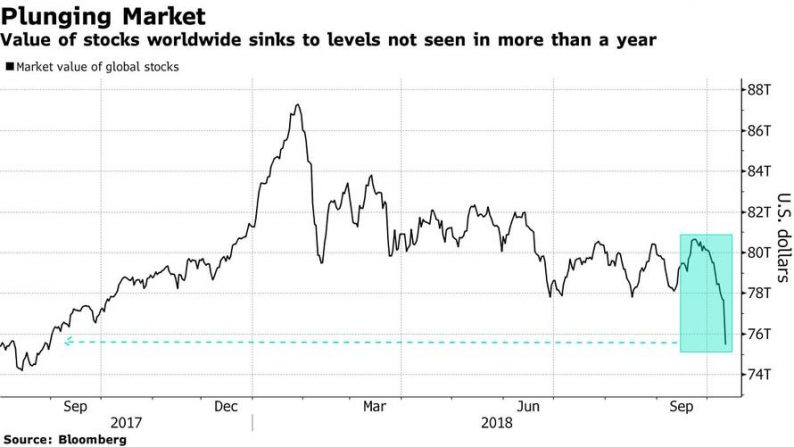

Still, despite the sea of green on trader monitors this morning which showed the E-mini future up as much as 40 points in early trading, rebounding once again above the 200-DMA the S&P was set for its worst month since Sept. 2011 while the Nasdaq was looking at the worst monthly carnage since the financial crisis.

After a partial recovery in Asian shares overnight, European stocks opened higher, with the pan-European STOXX 600 up 0.5% on the day, trimming earlier gains of over 1%; the broad index gained for the first time in three days, though still headed for its worst week since February, led by miners as most industrial metals gained. Germany’s DAX up 0.5% while Britain’s FTSE 100 gained 0.7%.

“Some traders are cautiously buying back into the market today, but the underlying issues which brought about the sell-off are still relevant,” said CMC Markets analyst David Madden.

Earlier, the MSCI Asia Pacific Index rose from the lowest level since May 2017, with shares in Hong Kong and South Korea leading the way, while China’s Shanghai Composite rose 0.9%, recouping earlier losses of 1.8% after the latest trade data from China showed China’s trade surplus with the United States hit a record high in September as well as solid expansion in China’s overall imports and exports, suggesting little damage from the tit-for-tat tariffs with the United States.

Still, China’s bounce came after the index fell 3.6% on Thursday to hit a one-and-a-half-year low; on the week, it is still on track for a weekly loss of 3.6 percent. So far this week, Chinese and U.S. shares are among the worst performers, a sign investor worries about the trade war are growing. China A shares are still down 8.7% this week.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 2.15%, the biggest in more than two years, as China’s trade data eased some concern about the impact of the trade war and added to bullish sentiment on Friday, while some noted that the decision by U.S. Treasury staff to refrain from labeling China a currency manipulator was a positive for stocks, although as noted last night, the latest PBOC yuan fixing that was the weakest relative to the dollar since February sent the Yuan sliding.

Boosted by China’s trade data, emerging-market stocks headed for the biggest gain in more than two years, and most developing-nation currencies advanced against the dollar.

U.S. equity-index futures gained 0.9% as the S&P 500 was set to snap its six-day losing streak – the longest of the Trump administration – when American markets open on the first official day of earnings season.

Meanwhile, as traders debate whether the correction is i) over and ii) has created buying opportunities, the focus turns to third-quarter earnings, with JPMorgan, Citigroup, and Wells Fargo kicking off Q3 earnings season this morning.

MSCI’s U.S. index has dropped 5.5%, compared with a 4.9% fall for MSCI’s world stock index as the US now appears to be catching down to the world.

“We’re still left with the sense that there has been a significant shift that markets now have to take stock of,” said Chris Scicluna, head of economic research at Daiwa Capital Markets in London.

“There could be more risk reduction into the weekend as investors position more defensively,” Oanda head of trading Stephen Innes wrote in a note. “But this does offer a significant window of opportunity for the not so meek of heart.”

Meanwhile, Gold, which had risen to a 10-week high on the back of the selloff, fell half a percent on Friday, down to $1.217.31 an ounce.

The yield on 10-year Treasuries edged up to 3.170%, reversing earlier falls on flight-to-quality bids. It is still off its seven-year high of 3.261 percent touched on Tuesday, but a further rise in the U.S. borrowing costs could hurt risk sentiment.

“Asian stocks appeared to have stabilized, but ultimately where U.S. bond yields will settle down will be key,” said Teppei Ino, senior analyst at MUFG Bank.

Also adding to the confusion for investors, Trump launched a second day of criticism of the Federal Reserve on Thursday, calling its interest rate increases a “ridiculous” policy. While that does not appear to have shaken investor confidence in the Fed’s independence, some investors suspect expectations on future rate hikes could be undermined if Trump raises his threats levels.

“I doubt Trump will tolerate a further rise in U.S. rates ahead of U.S. mid-term elections. I believe the rise in U.S. yields and the dollar’s rally are coming to a turning point,” said Naoki Iwami, fixed income chief investment officer at Whiz Partners in Tokyo.

The dollar lacked momentum against a basket of major currencies as U.S. bond yields stayed off recent peaks. The index which measures the greenback against a basket, traded within a tight range, last at 95.009. The euro was 0.1 percent lower at $1.1582, after a gain of 0.65 percent on Thursday. But the yen eased to 112.27 to the dollar after hitting a three-week high of 111.83 on Thursday.

In commodities, West Texas oil recovered but is still heading for the biggest weekly drop since May, while gold slipped and copper led a gauge of industrial metals higher. Brent crude futures rose 1.1 percent to $81.14 a barrel, holding off a four-year high of $86.74 touched on Oct 3.

Leave A Comment