World stocks and commodities rose on Monday, boosted by upbeat Chinese data, while U.S. oil futures jumped to a near six-month high as escalating tensions between the Iraqi government and Kurdish forces threatened supply. Global markets digested the large amount of weekend newsflow, and clearly liked what they saw as S&P futures were modestly in the green, as both European and Asian stocks are higher.

The USD is marginally stronger after Yellen’s comments suggest the Fed may look through weak inflation. Still, for those who missed this weekend financial elite extravaganza, Yellen stated that new normal will be lower interest rates than seen historically and that inflation has been largest surprise for the US economy this year. Yellen added that gradual hikes in fed funds rate are likely to be appropriate during next few years and that she will be paying attention to inflation data in the upcoming months, although she guesses that the soft reading will not persist. Meanwhile, Fed’s non-voting soft-hawk Rosengren said 3 to 4 rate hikes next year will probably be appropriate and that the Fed may need to overshoot on rates if unemployment is below 4% while inflation reaches target.

Looking at the big macro picture, via Bloomberg:

Meanwhile, tension over North Korea continues to simmer. The U.S. and South Korean navies began a joint drill involving around 40 warships, amid signs North Korea is preparing for another provocation such as a missile launch. North Korea’s state-run media agency KCNA on Saturday criticized the exercise, calling it a “reckless act of war maniacs.”

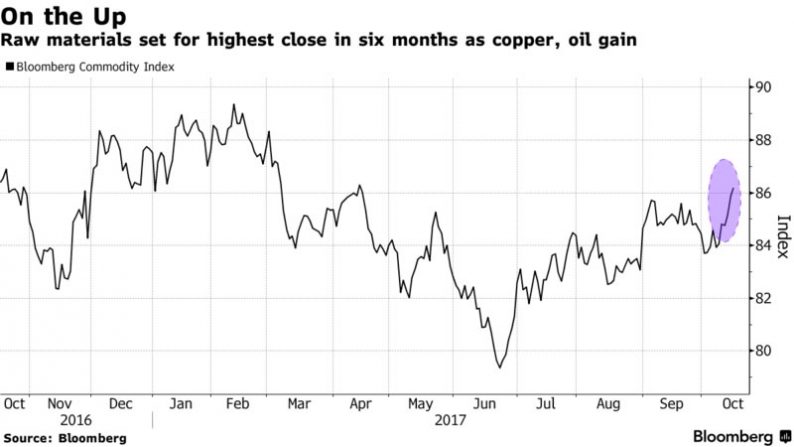

Stocks in Europe nudged higher after their longest weekly rally since 2015, led by miners, as gains in oil and copper drove Bloomberg’s gauge of commodity prices to a six-month high.

The Spanish IBEX index lags against its counterparts, down -0.7%on Catalan fears with Spanish banks leading the losses. As reported previously, the Catalan Leader suspended independence mandate to pursue dialogue with PM Rajoy, however the letter sent by Puigdemont failed to clarify whether he has declared independence or not, prompting the head of the People’s Party in Catalonia Xavier Garcia Albiol says Puigdemont’s answer shows he is irresponsible. CaixaBank falls 2.4%, BBVA down 1.4%, Bankia down 1.5%; the IBEX is down 2% since independence vote on Oct. 1, vs 1% gain for Stoxx 600 over same period. Elsewhere, Convatec shares fall some 14% after announcing a profit warning, while strength in material names are helping European bourses make slight gains this morning.

The MSIC Asia index was higher by 0.6%, its highest level since November 2007, led by Australia’s ASX 200 (+0.3%) underpinned by strength in commodity related stocks after crude approached $52/bbl and iron ore gained over 4%, while Nikkei 225 (+0.5%) extended on its best levels in over 2 decades. Elsewhere, Hang Seng (+0.8%) outperformed and posted its highest close since December 2007 following stronger than expected Chinese Aggregate Financing, New Yuan Loans and PPI data, although the Shanghai Composite (-0.4%) lagged after the PBoC kept its liquidity operations at a minimal. Meanwhile, China’s ChiNext Index of small-cap shares drops as much as 2.3%, the biggest intraday loss since July 17, amid expectations that liquidity could tighten and as investors turn more cautious ahead of the Communist Party congress this week. “Zhou Xiaochuan’s comments signal that China will move further to rein in financial leverage and is unlikely to maintain an easy liquidity environment,” says Shen Zhengyang, Shanghai-based analyst with Northeast Securities Co.

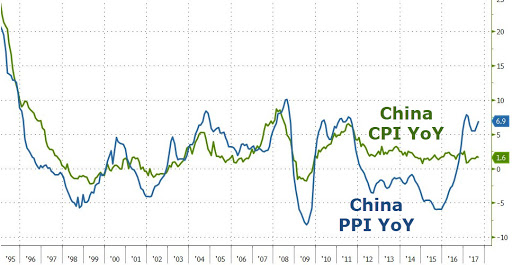

Overnight, as reported previously, China CPI printed at 1.6% Y/Y, in line with expectations, and down from, 1.8% in August largely due to high year-over-year base effects, but it was PPI to come in smoking hot, jumping from 6.3% last month to 6.9% Y/Y, slamming expectations of a 6.4% print and just shy of the highest forecast, driven by the recent surge in commodity costs and strong PMI surveys.

The stronger than expected PPI has pushed China’s 10Y yield to the highest in 30 months, or since April of 2015.

Japan’s torried rally continued as technology firms and banks bolstered the Japanese stock market, sending the Topix index to its sixth day of gains, up 0.6%, and its longest winning streak for this year. All but four industry groups in the Topix advanced, while the Nikkei 225 Stock Average rose for the 10th day, the longest stretch since June 2015. Technology shares mirrored gains in U.S. peers as chipmakers and internet giants bolstered the S&P 500 Index at the end of last week. Automakers underperformed after the yen strengthened against the dollar for a second day on Friday as data showed the core U.S. consumer price index rose 0.1 percent in September from a month earlier, below the estimate of 0.2 percent. “Risks of not buying into Japanese equities are rising,” said Masahiko Sato, an analyst at Nomura Holdings Inc. in Tokyo. “In the midst of a global economic expansion, local corporate earnings are improving and equities are looking cheap. Foreign investors are buying into this.”

The Bloomberg Dollar Spot Index rose 0.1 percent as the euro weakened and Spanish shares fell after Spain’s government gave Catalonia a new deadline to back down from its independence claim. The pound extended gains as British Prime Minister Theresa May headed for Brussels to intervene in deadlocked exit negotiations. The Japanese yen increased less than 0.05 percent to 111.81 per dollar.

Leave A Comment