In retrospect it appears Tom DeMark was spot on with his Wednesday prediction, made just as the Dow Jones was down some 500 points that that very day was “an interim low” to be followed by a 5-8% rebound (at which point the selling would resume). In fact, those trading Japanese stocks saw virtually the entire predicted rebound take place in just one day as the Nikkei soared by almost 6% overnight, or nearly 1000 points, the biggest jump in 4 months, while risk everywhere else around the globe has likewise exploded higher, as crude has stormed back over $31/barrel.

In other words, overnight we have seen a tremendous relief rally from historically oversold conditions in which AAII bulls hit a 10 year low: largely as most predicted, despite (actually thanks to) even more negative global macro economic data.

There was just one problem: recall what DeMark said about the market forming a bottom:

Markets bottom when the last seller has sold and markets top when the last buyer has bought. We are looking for a bottom that’s a secondary bottom where you make one bottom, you rally, make a lower low and the internals of the market show that there’s strength and at the same time when we make that low there’s a low of negative news: we don’t want to see positive news from the government; we don’t want to see positive news from central banks. That interferes with the rhythm of the market.

So what drove the overnight surge? Here is a sample of “explanatory” headlines from Bloomberg:

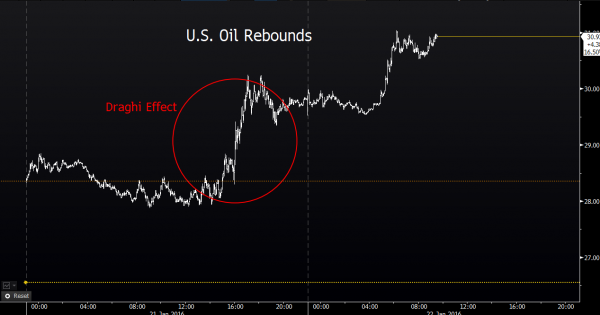

To be sure, it all started with Draghi’s latest jawboning of risk higher, which sent oil surging above $28, pushing up all risk assets with it, on expectations that March is the date when the ECB will boost its QE, memories of the December slaughter long forgotten.

In case it is still unclear, Bloomberg lays it out: “The turnaround in sentiment came amid signs central banks may be prepared to act after $7.8 trillion was erased from the value of global equities this year on China’s slowdown and oil’s crash. Diminished inflation expectations and a strengthening yen are seen as increasing pressure on the Bank of Japan to enlarge stimulus at its meeting next week. China will keep intervening in its equity market to “look after” investors and has no intention of further devaluing the yuan, Vice President Li Yuanchao said.”

And just in case, here is another explainer: “There is hope of more stimulus in March and potential for even more stimulus in Japan and China, so if we get concrete positive economic news the rebound could last into next week,” said John Plassard, senior equity- sales trader at Mirabaud Securities. “I told my clients to fasten their seatbelts and wait for better news, and this is finally happening.”

In other words, more of the same that brought the market to the same unsustainable level from which we just had a crash big enough to validate half a recession. No wonder even JPM says to sell all rallies.

For now, however, enjoy the bear-market rally in which stocks rose around the world, extending Thursday’s rebound from a 2 1/2-year low. Oil surged with emerging-market currencies, while haven assets retreated. European shares headed for the best week in two months, the euro approached a two-week low and Spanish and Italian bonds rallied after European Central Bank President Mario Draghi indicated he may bolster economic support as soon as March. Crude was poised for its steepest two-day rally in five months and the Russian ruble rebounded from a record low. Asian stocks climbed the most since September on speculation Japan and China may also take steps to calm markets.

“It’s a classic oversold bounce after Draghi’s comments yesterday and the noise on Japanese stimulus overnight, the question is where do we go from here,” said Veronika Pechlaner, who helps oversee $10 billion at Ashburton Investments, part of FirstRand Group. “It’s become harder and harder for stimulus to really support the economic fundamentals so it doesn’t mean a medium- and long-term change, but at least we have a bit more stable trading environment for a couple of days.”

Summarizing where we stand:

And just like that, we have gone from epic gloom and doom and a 560 Dow Jones plunge to sheer euphoria in about 48 hours.

Looking closer at regional markets, we start in Asia where equity markets traded mostly higher following the positive close on Wall St. in the wake of ECB President Draghi’s dovish comments, while a rebound in the energy complex and hopes of BoJ easing also bolstering sentiment. Nikkei 225 (+5.9%) outperformed as the weaker JPY supported exporters, while reports that the BoJ is said to be considering further easing saw the index advance by nearly 1000 points. Elsewhere, the ASX 200 (+1.1%) was led higher by gains in energy and large mining names, while the Shanghai Comp (+1.3%) was also led by the crude recovery, despite underperforming after Shanghai margin debt fell for the 15th consecutive day which is the longest streak of declines on record. Finally 10yr JGBs traded flat initially tracked the losses in USTs, but then pared with the BoJ also in the market for JPY 1.26tr1 of government debt.

BoJ is said to be considering further easing amid economic uncertainty, with the central bank said to be mulling measures to address the impact of the slump in oil prices on its price target and is likely to extend the time frame to reach the price-goal, according to a senior official.

Leave A Comment