The nightmare on Wall Street may finally be over with markets getting a treat this Halloween… but will the trick emerge during the usual last hour of trading?

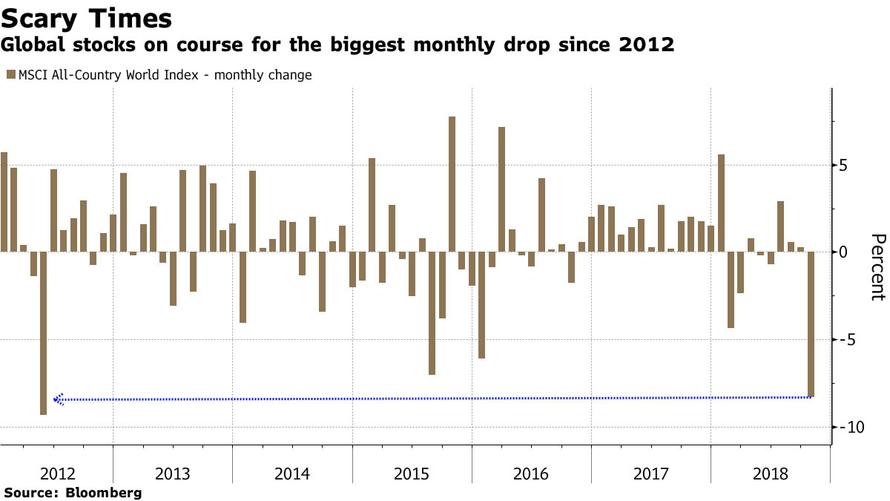

It is a sea of green as stocks hope to end a turbulent month – which saw the biggest losses for global equity markets since 2012 – in an upbeat mood, with European stocks sharply higher following a rebound in Asia as US equity futures extended on their Thursday gains which saw the Dow soar by more than 400 points, while the dollar remained near one year highs as Treasury yields posted another day of modest increases.

A confluence of factors ranging from China-U.S. trade tensions to worries about global economic growth, corporate profits and higher U.S. interest rates have spurred volatility in financial markets in the past few weeks. But shares in Europe were expected to follow Asia’s lead higher on the last day of the month, while U.S. S&P mini-futures edged up 0.3 percent.

Every sector in Europe’s Stoxx 600 Index rose, with miners and energy companies leading the way. France’s CAC 40 (+1.9%) outperformed peers with the index pushed higher by gains in heavyweights L’Oreal (+5.4%) and Sanofi (+5.0%) post-earnings. Energy names lead the gains as the complex retraced yesterday’s losses, while utility names underperformed. Tech stocks thanks to Dialog Semiconductor (+10.0%) which rose to the top of the Stoxx 600 amid optimistic earnings, while Nokian Tyres (-14.7%) plumbed the depths after cutting guidance due to currency impacts.

Earlier in Asia, the MSCI Asia-Pacific index rose 1%, with Japanese stocks the stand-out performers thanks to a 2.2% advance in the Nikkei, reassured by the Bank of Japan’s signal that it will keep its ultra-easy policy for some time to come. Even so, Asia was on track to fall around 11% this month, which would be its worst monthly performance since September 2011, dropping to its lowest level since February 2017 this week.

Hong Kong’s Hang Seng rose 1 percent on Wednesday and the Shanghai Composite Index climbed 1.4% as weaker-than-expected factory activity data reinforced views that Beijing will roll out more support measures for the economy.

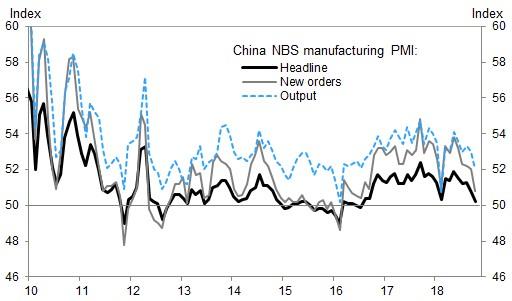

In the latest economic disappointment out of Beijing, the latest official NBS manufacturing PMI fell to 50.2 in October, the lowest level since July 2016 as almost all sub-indexes showed weaker growth momentum. The non-manufacturing PMI missed expectations as well, printing at 53.9, below the 54.9 in September, due to the weaker services PMI.

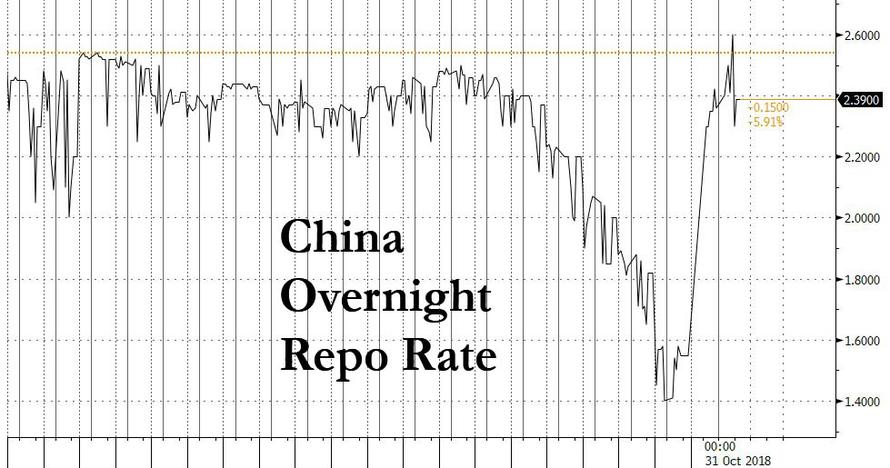

In Beijing’s ongoing attempt to stabilize the yuan, China’s overnight repo rate surged by 84bps – the most in more than four years – to 2.39%, as authorities take aggressive steps to combat bets against the yuan, which held near the weakest level in a decade against the greenback.

Even so, hopes of boosting the Yuan have proven futile so far, with the USDCNH rising to the highest since January 2017, just shy of 6.800 and knocking on the door of the critical 7.00 level, with today’s move largely a function of renewed dollar strength. The Chinese currency was on track for a loss of 1.4% in October, its seventh straight monthly loss — the longest such losing streak on record

Australian stocks ended 0.4 percent higher, South Korea’s KOSPI added 0.7 percent.

Today’s gains will be a welcome respite in a month that has seen a near historic selloff: the broader MSCI All-Country World index was down 8.6% this month, its biggest monthly drop since 2012, losing $4 trillion in market value.

The narrower MSCI World Index was down 8.43% and has wiped out $4.5 trillion in October. The month-end gains followed a sharp bounce for Wall Street’s main indexes, which jumped more than 1% on Tuesday, helped by strong gains for chip and transport stocks as investors took advantage of cheaper prices following the steep recent pullback for equities.

Equity bulls will be hoping this rebound can last following a series of bounces in the past few weeks that quickly gave way to declines as late day algo selling put a dent on carbon-based BTFDing.

Corporate results will be key to sustaining the share gains: attention will next turn to earnings from Apple on Thursday. But trade risks continue to simmer in the background, with the U.S. jobs report is due Friday and US midterm elections are creeping closer, all of which have the potential to further roil markets.

“The recent slide in equities had gone to such an extent that it was bound to invite buyers, such as in the Japanese stock market,” said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui Asset Management in Tokyo. Ichikawa said the U.S.-China trade row will likely remain a factor of concern beyond the U.S. midterm elections on Nov. 6.

In FX, the Bloomberg Dollar Spot index headed for its best month in two years amid supportive month-end flows that offset profit-taking by short-term investors. Price action in the euro was quiet while the pound rebounded, tracking trading in the options market. The yen was steady as the Bank of Japan left its monetary stimulus unchanged and kept its 10-year bond yield target at about zero percent as it updated price forecasts that confirm it won’t meet its inflation target for years to come. Australia’s dollar declined following a weaker-than-expected inflation reading and the abovementioned miss in China’s PMIs. The Indian rupee fell as much as 0.6% on reports that the central bank governor may consider resigning amid growing tensions with the government.

In rates, the 10Y TSY yield climbed 2bps to 3.14%, the highest in more than a week. Germany’s 10-year yield advanced two basis points to 0.39%. Britain’s 10-year yield advanced 3 bps to 1.434%, the largest gain in more than a week. The spread of Italy’s 10-year bonds over Germany’s declined 9 bps to 3.0205%.

Oil prices recovered slightly after dropping to multi-month lows the previous day on signs of rising supply and concern that global demand for fuel will fall victim to the U.S.-China trade war. WTI futures were up 0.38% at $66.43 per barrel after dropping to $65.33 on Tuesday, the lowest since mid-August. Brent crude gained 0.62% to $76.38 after a decline of 1.8% on Tuesday. Gold declined and oil recovered from a two-month low.

Leave A Comment