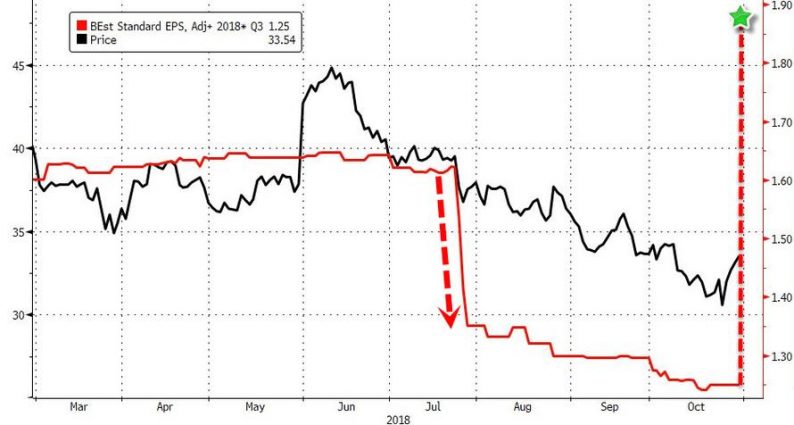

General Motors stock is soaring in the pre-market after smashing earnings expectations (the 14th straight quarterly beat) and hinting that full-year earnings may be at the high end of the range that it has forecast.

In boosting adjusted profit to $1.87 a share, GM beat dramatically lowered expectations that earnings would slip from a year earlier and overcame global auto sales leveling off (with China deliveries plunging 15% YoY).

Bloomberg highlights the following key insights:

GM’s sales in the U.S. have been down slightly this year and dropped 15 percent in China in the quarter, so expectations for this report were low.

The automaker also said that it expects profit for the year to hit the high end of its previous guidance, which was for between $5.80 and $6.20 a share. Earnings could even beat $6.20 a share depending on “macro factors,” spokesman Tom Henderson told reporters at the company’s headquarters in Detroit.

Slower retail sales didn’t hurt GM’s performance. In the U.S., the automaker continues to sell more expensive models. New sport utility vehicles including the Chevrolet Traverse and Equinox have been selling well and commanding better prices.

Delivered nearly 700,000 vehicles in the U.S. in 3Q; GM China delivered nearly 836,000 vehicles.

GM’s income from its China operations was a third-quarter record. While retail sales dipped, this was driven by the low-priced Baojun brand, while the company delivered more lucrative Cadillac models such as the new XT4 SUV.

All of this has sparked a pre-open squeeze, sending GM up over 10%…

So, despite the plunge in China deliveries, this beat seems driven by China revenues – we wonder if this is a one-off pre-tariffs spike?

Leave A Comment