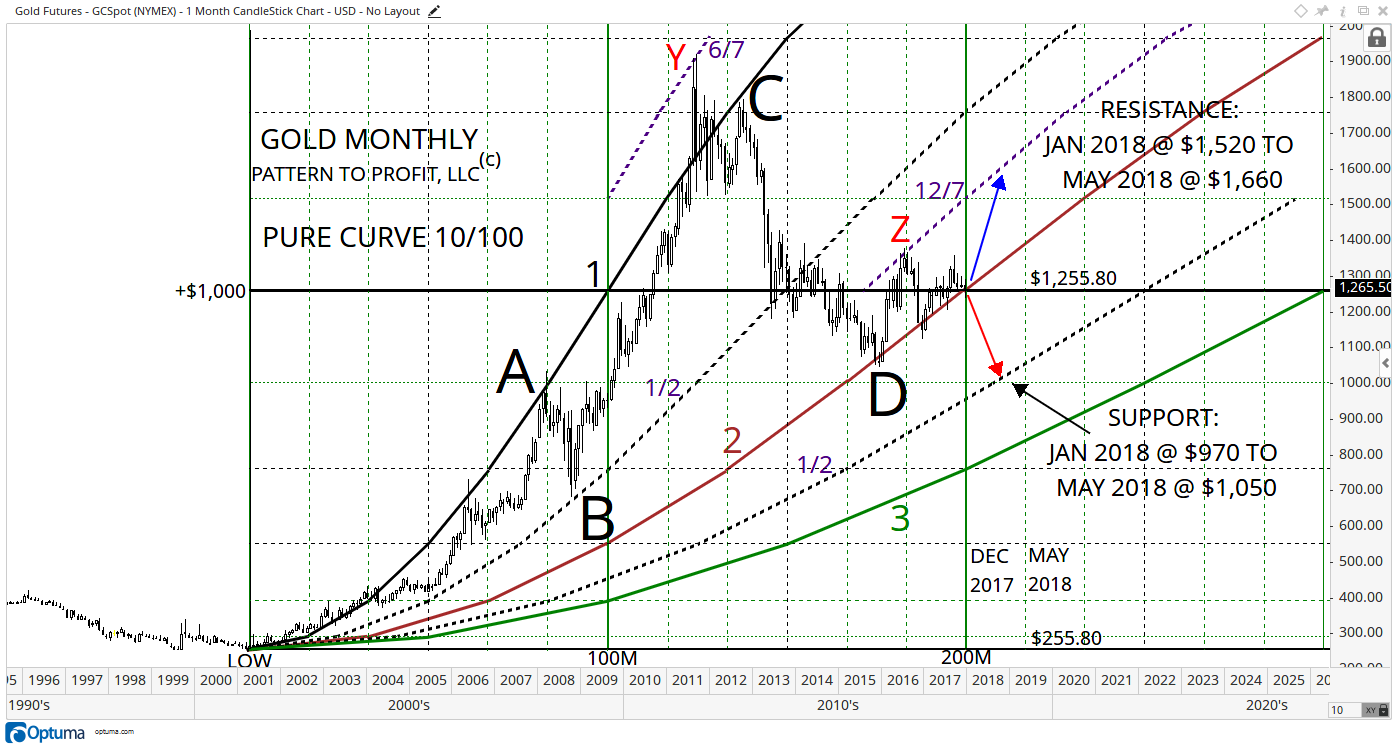

This possibility has long-term bullish implications from monthly geometric analysis, where the market is at a critical decision point.

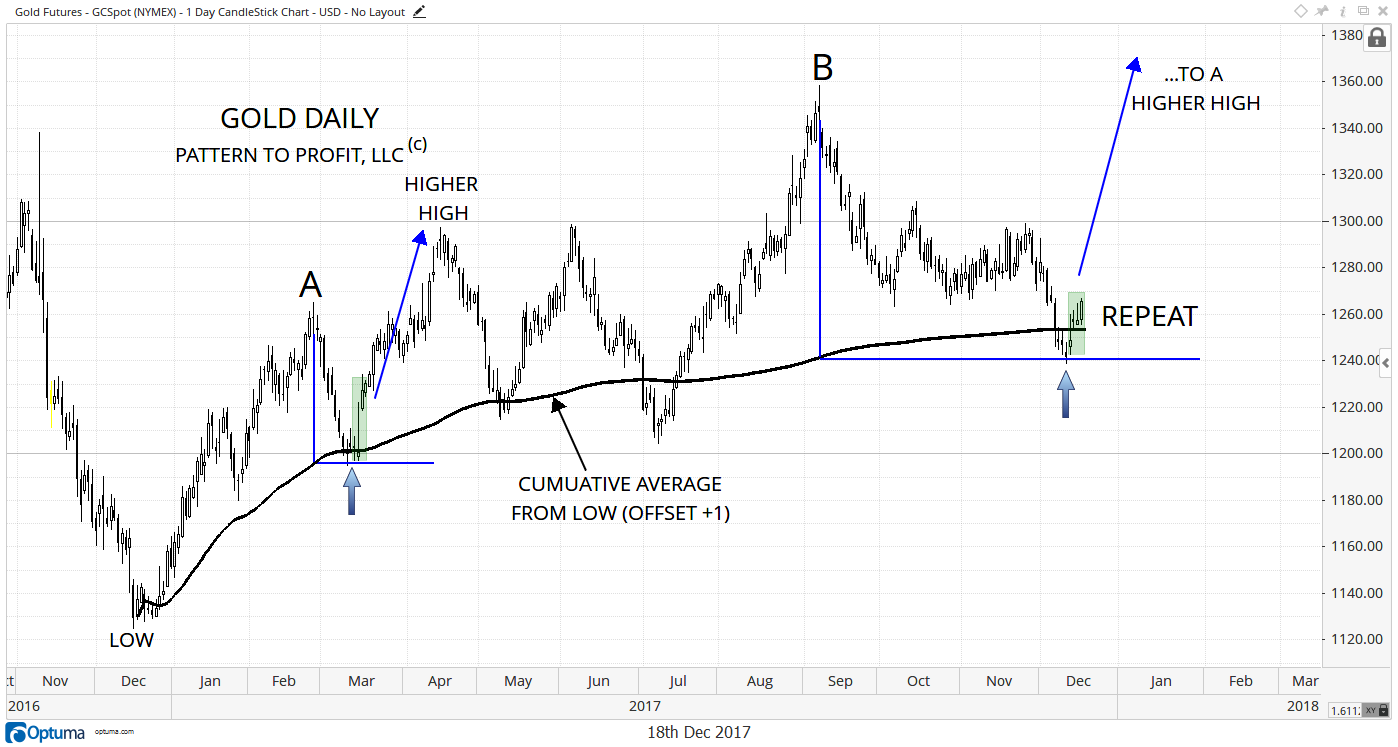

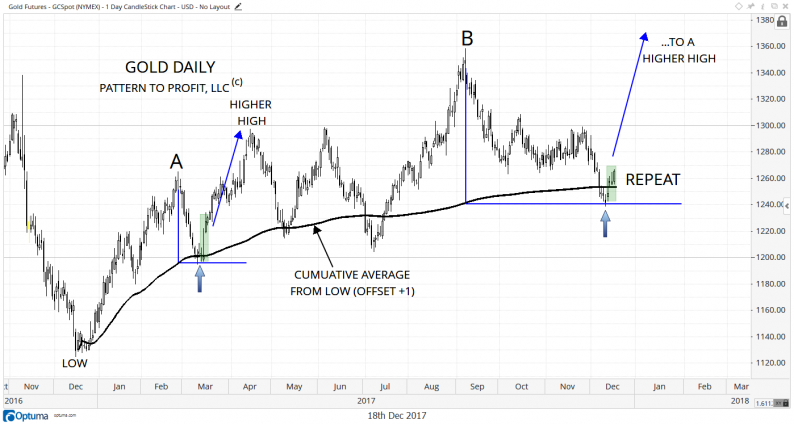

Gold (XAU/USD) made a potentially important low of $1,238.30 last Tuesday, December 12. By employing a cumulative average (black, offset +1 day) from the major low of $1,124.30 of December 2016, and then squaring the highs at A & B with this average (by forming 90o angles with blue vertical and horizontal lines), two of the recent swing lows are revealed to be almost identical (blue arrows).

If this relationship holds, an eventual high above B ($1,358.50) can be expected.

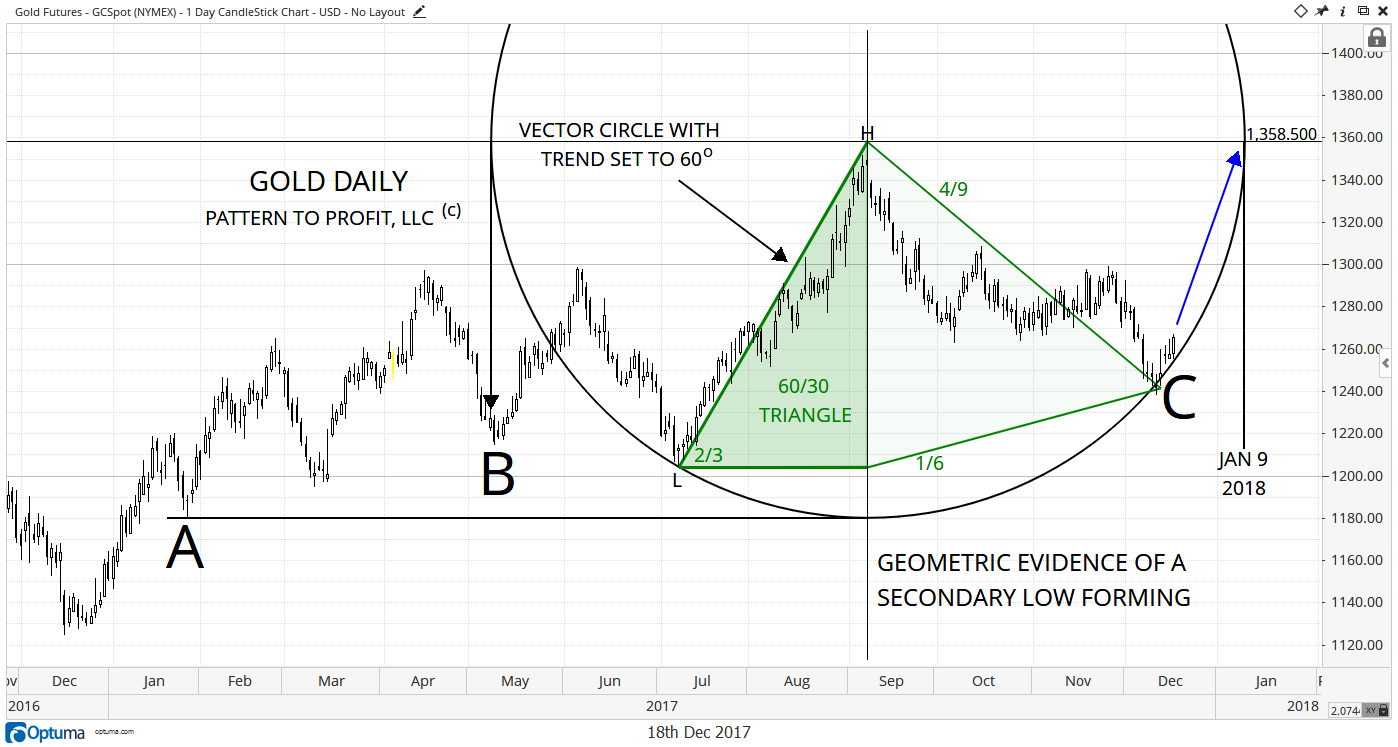

The following daily geometric analysis also agrees. A vector concentric circle has been drawn on the chart. Both the resulting circle’s left time point and bottom price level yield preceding lows at A & B. Therefore, the current markets bounce from circular support, and also from a harmonically matching triangular point (lighter green triangle), make a sound statement for the likelihood of higher prices for gold:

A preceding downtrend (marked L-H) is set at 60o (2/3 of 90o) forming a ‘60/30’ triangle (the angle of the high is 30o).

Therefore, we are bullish short-term on gold to at least the $1,360 area (making a higher high), with January 9, 2018 as a potential reversal day. At the same time there are some long-term bullish implications from this analysis.

The following monthly chart utilizes one of my applications of sine waves: in this case, the analysis is based on a ‘pure curve’ of $1,000 over 100 months (labeled ‘1’, solid black), stemming from the major low of $255.80 in April 2001:

Several dynamics are present in this sine wave analysis that point to a potential launch for gold:

Leave A Comment