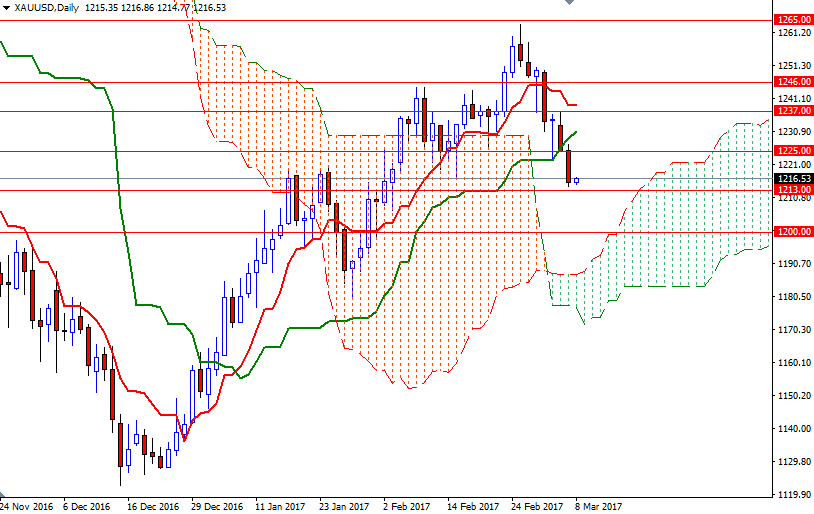

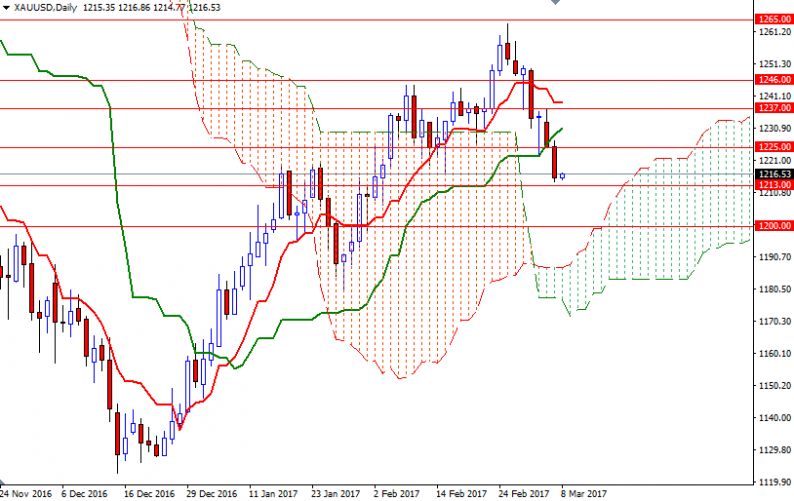

Gold prices closed at their lowest level since February 2 on anticipation of tighter U.S. monetary policy and as the dollar strengthened against other currencies. The XAU/USD pair slumped to $1214.10 an ounce before recovering slightly to the $1216.53 level. Technical selling was also behind gold’s 0.81% drop on Tuesday. Not surprisingly, dropping below the $1222.88 level dragged prices towards the $1213/1 area.

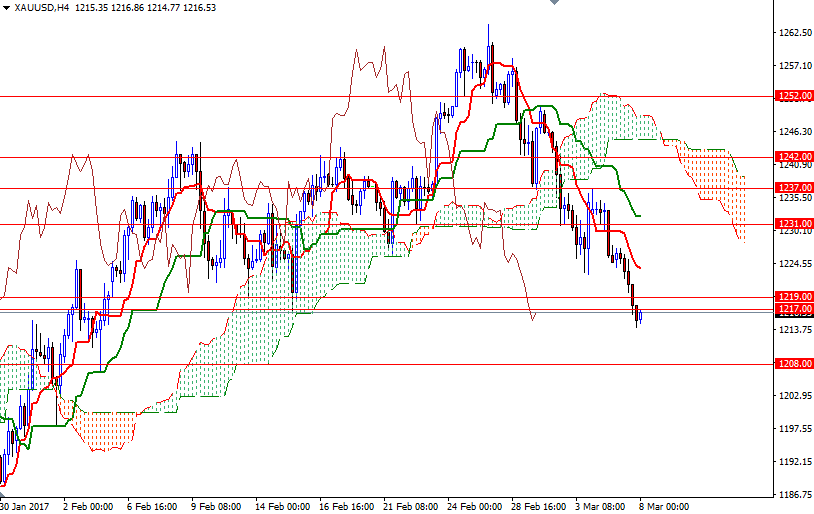

The greenback is being given a lift by the perception that the Federal Reserve will hike interest rates at its FOMC meeting next week but we may enter a sideways phase ahead of the most important economic report of the week on Friday – the jobs report for February. Trading below the Ichimoku cloud on the 4-hour chart and negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-day moving average, green line) lines, along with Chikou Span/Price cross in the same direction, suggest that the gold bears have the near-term technical advantage.

Down below, there is an anticipated support zone between 1213 and 1211 so the bears will need to capture this camp if they intend to push prices lower and reach the 1208/5 region. A decline below 1205 could trigger further weakness and open a path to 1200-1198. To the upside, the key area to watch will be 1219/7. The bulls will have to push the market convincingly beyond 1219 so that they can make an assault on 1225/3. If this resistance is broken, then 1228 and perhaps 1233/1 may be the next targets.

Leave A Comment