“For where men have made the earth trodden underfoot, and have largely veiled the heavens themselves, it is but natural that they should think that they have made everything, and that it is they who rule it.”

Robert Hugh Benson, Lord of the World

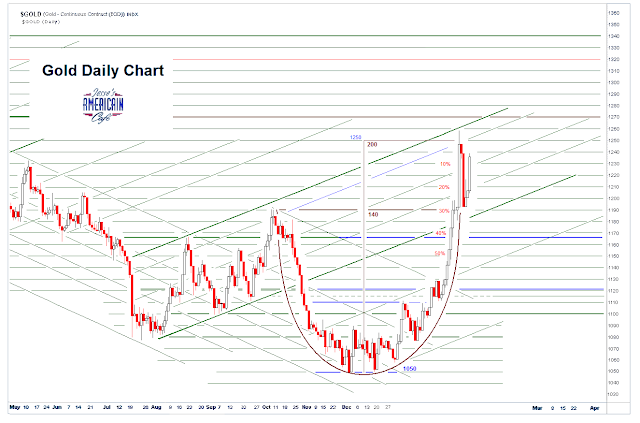

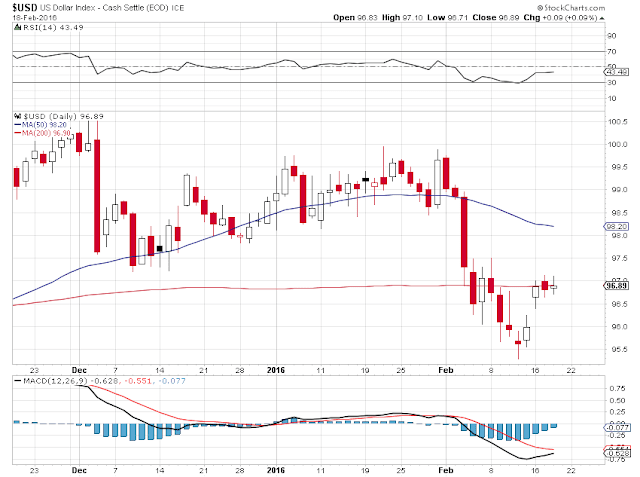

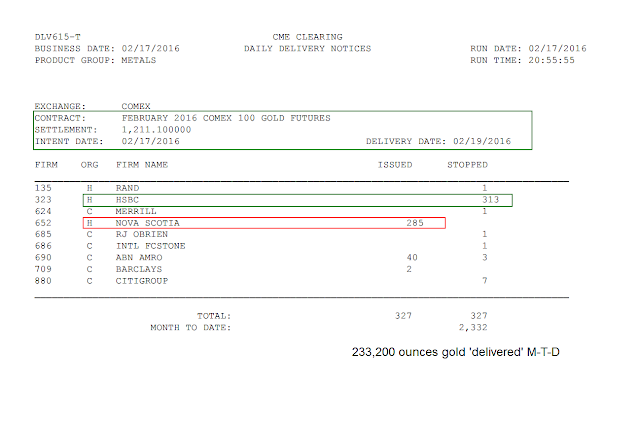

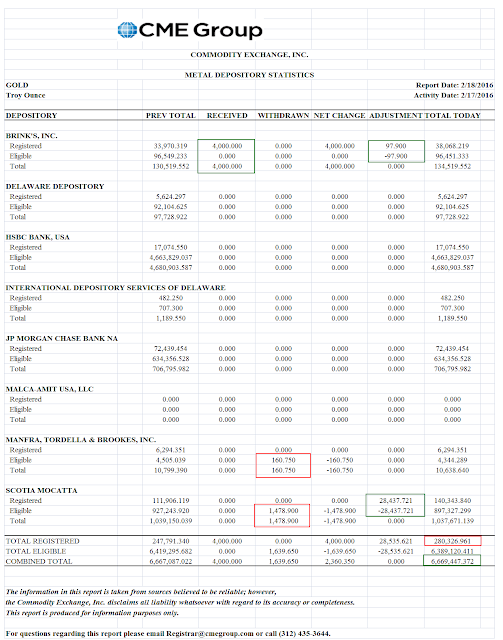

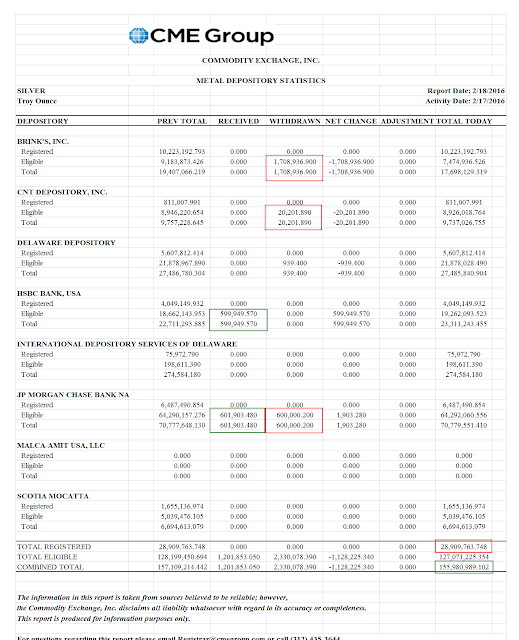

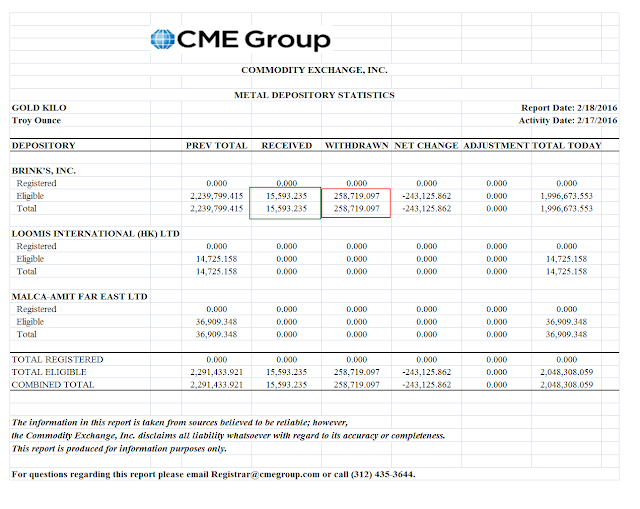

The data from The Bucket Shop is really not very instructive, except to paint the broader trends, and the little ‘tells’ of problems behind the curtain, if you are adept enough to watch for them.

Just because you have a lot of detailed reporting does not mean it is useful. Look at the US Labor Market numbers for example. Complexity and detail there was a-plenty in Madoff’s reports. What he, like most frauds, were short of was substance underlying the false narrative.

And most of the indicators in the precious metals market that I watch tell of a tightness in the physical supply, and especially for gold.

Corroborative data is there if you look for it, in the huge physical buying in Asia, in the shrinking ‘gold float’ in London, and in the draining of physical supply from the ETFs and exchanges of the West.

Every so often something happens, like the failure of MF Global, that can be dismissed as a one off but that exposes the rot of leverage and multiple rehypothecation of physical supply behind the facade of business as usual by ‘highly respected people.’

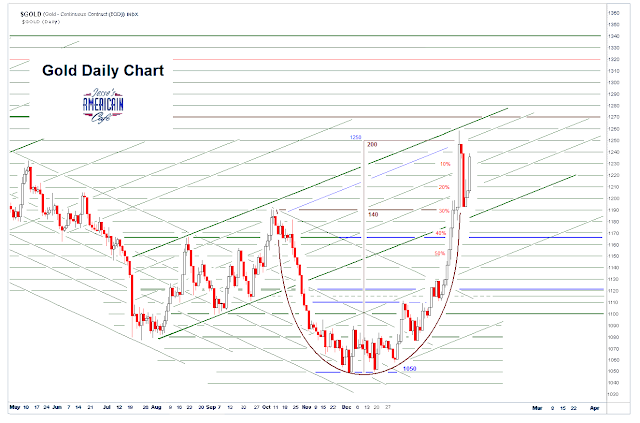

If things continue as they are now, I suspect that the tide of deceit and manipulation will be going out later this year. And then we will see what has been concealed beneath the water line for so long.

I will be a little surprised if it shows up in this particular active month of February. I am looking towards the latter part of the year. But that story is not being told here in paperland, but in the markets of Asia, and the bullion centers in London and Switzerland.

Have a pleasant evening.

Leave A Comment