Gold prices ended Tuesday’s session up $8.15 an ounce, supported by safe-haven demand. Global stock markets were mostly weaker as worries about corporate earnings, softening Chinese growth and Middle East tensions rattled investors. A lower U.S. dollar index and a decline in Treasury yields were also supportive daily elements for gold. XAU/USD drifted higher as anticipated after the market climbed above the $1225 level, but it was unable to break through the resistance at $1240.

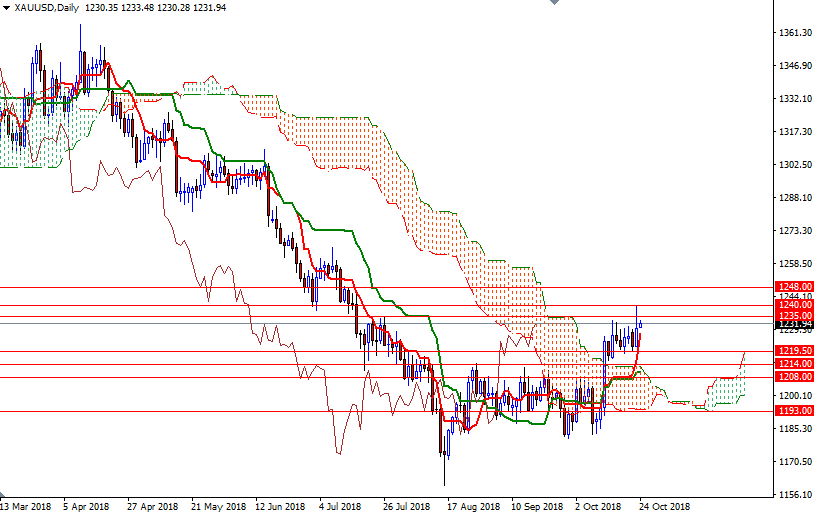

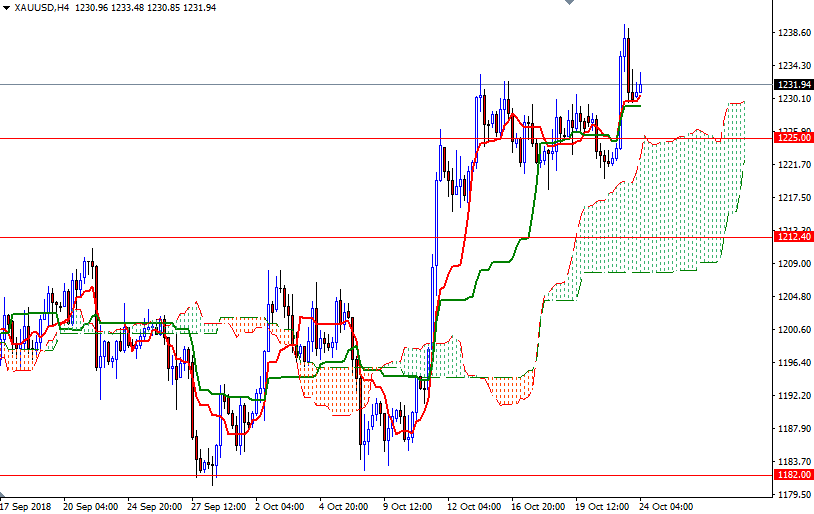

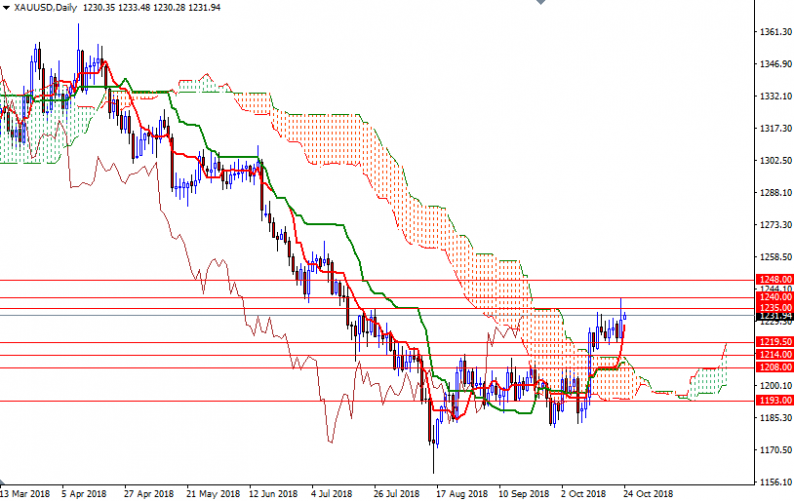

Technically, the bulls have the near-term technical advantage. The market is trading above the Ichimoku clouds on the daily and the 4-hourly charts; plus, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned. XAU/USD is in a better technical posture to suggest higher prices are likely in the near term. However, as I pointed out earlier, the bulls have to lift prices above 1240/35, the confluence of the 200-week moving average and the 38.2% retracement of the bearish run from 1365.10 to 1160.05, to make a run for 1252/48.

If the resistance at 1235 remains intact, keep an eye on the 1228 level. A break below 1228 would suggest a pullback to 1225/4, the top of the Ichimoku cloud on the H4 chart. The bears have to drag prices below 1224 to challenge the next support in the 1220.50-1219.50 area.

Leave A Comment