It’s pretty calm at the stock market for the moment. When you want some action, it’s not the place to be. If we wouldn’t know better, we would say it’s summer already. Thank God there’s a place where you can find plenty of action: the gold market.

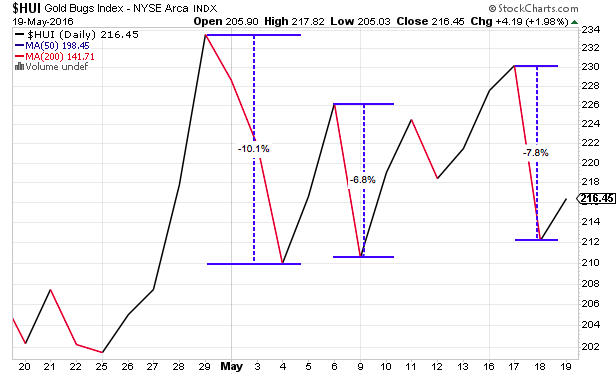

Especially gold mining shares are seeing a lot of action lately. Since the beginning of May we saw 3 pretty harsh smackdowns: -10%, – 7% and -8% in a matter of days. It’s enough to shake your head and throw in the towel.

Most investors can’t handle this kind of action. But those are the same investors who can’t handle big gains ether. This is normal in a new bull market. The HUI started the year at 110, so a pull down from 230 to 210 is not a big deal a couple of months later.

It gets better:

This is only a hiccup in the secular bull market that started at the beginning of this century. And It’s just getting warmed up for the next round. Don’t forget the HUI’s previous record stands at 630 point. But this time it’s different, gold mining shares are mean, lean and … still very cheap.

This all makes sense:

In a bear market, rallies are short but powerful

In a bull market, corrections are short but intense

Billionaires are buying gold mining shares

The latter is what you see today. A bull wants as little investors as possible on his back on the way to new highs. Don’t be bothered from a little turbulence when you want to make some very big gains. You got to keep the focus on the big picture, this was only the first phase, the manic phase is still a long way ahead.

And we are not alone in this trip. Billionaires are buying gold and gold mining shares.Bill Gross, Stanley Druckenmillar, Jim Grant, Jeffrey Gundlach, George Soros, … they’re all recommending buying gold. Soros even bought Barrick Gold to be a 7,5% stock in his portfolio.

But here’s the kicker:

Soros knows why he is buying gold mining shares:

Leave A Comment